| þ | Filed by the Registrant | ¨ | Filed by a Party other than the Registrant | |||||||||||

| Check the appropriate box: | |||||

| ¨ | Preliminary Proxy Statement | ||||

| ¨ | Confidential, for Use of the Commission Only (as permitted by RULE 14a-6(e)(2)) | ||||

| þ | Definitive Proxy Statement | ||||

| ¨ | Definitive Additional Materials | ||||

| ¨ | Soliciting Material under | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||||||

| þ | No fee required | |||||||

| ¨ | Fee paid previously with preliminary materials | |||||||

| ¨ | Fee amount computed on table in exhibit as required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||||||

| ||||||||||||||

| ||||||||||||||

| Chairman of the Board | ||||||||||||||

|  | |||||||

| Erik B. Nordstrom | Peter E. Nordstrom | |||||||

| Chief Executive Officer | President | |||||||

| 2024 Proxy Statement | 2 | ||||||||||||

| 3 |  | |||||||||||||

|  |  | ||||||

| WHEN | WHERE | RECORD DATE | ||||||

| Wednesday, May 22, 2024 | virtualshareholdermeeting.com/JWN2024 | March 13, 2024 | ||||||

| 9:00 a.m. Pacific Daylight Time | ||||||||

| Items of Business | |||||

| To vote on the following proposals: | |||||

| 1 | To elect twelve directors to serve until the 2025 Annual Meeting of Shareholders | ||||

| 2 | To ratify the appointment of Deloitte as our independent registered public accounting firm to serve for the fiscal year ending February 1, 2025 | ||||

| 3 | To conduct an advisory vote regarding the compensation of our Named Executive Officers | ||||

| 4 | To transact any other business that may properly come before the Annual Meeting and any adjournment or postponement thereof | ||||

| Online At proxyvote.com |  | Toll-free Phone Call 1-800-690-6903 |  | Mail Vote Processing c/o Broadridge 51 Mercedes Way Edgewood, NY 11717 |  | Scanned QR Code Using your mobile device | ||||||||||||||||||||||||||||||||||

| 2024 Proxy Statement | 4 | ||||||||||||

|  |  | |||||||||||||||||||||||||||||||||||||||

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE | ||

| The accompanying Proxy Statement and the | ||

| 5 | 2024 Proxy Statement |  | ||||||||||||||||||

| Term | Definition | ||||

| 2023 Annual Report | Company’s Annual Report on Form 10-K filed with the SEC for the fiscal year ended February 3, 2024 | ||||

| AFC | Audit and Finance Committee of the Board | ||||

| ASC 718 | Accounting Standards Codification 718, Stock Compensation | ||||

| Board | The Board of Directors | ||||

| Broadridge | Broadridge Investor Communication Services | ||||

| Bylaws | Bylaws of the Company (as amended and restated September 20, 2023) | ||||

| CD&A | Compensation Discussion & Analysis | ||||

| CEO | Chief Executive Officer | ||||

| CFO | Chief Financial Officer | ||||

| CGNC | Corporate Governance and Nominating Committee of the Board | ||||

| Chairman | Our Board Chairman, a non-Executive position | ||||

| Clawback Policy | Executive compensation clawback policy contained in our corporate governance guidelines (as amended August 16, 2023) | ||||

| Committee | A committee of the Board of the Company | ||||

| Common Stock | Nordstrom common stock | ||||

| CPCC | Compensation, People and Culture Committee of the Board | ||||

| DDCP | Nordstrom Directors Deferred Compensation Plan | ||||

| Deloitte | Deloitte & Touche LLP | ||||

| DEIB | Diversity, Equity, Inclusion and Belonging | ||||

| DEIB Goals | Our DEIB goals at nordstrom.com/diversity | ||||

| EBIT | Earnings (Loss) Before Interest and Income Taxes | ||||

| EIP | Equity Incentive Plan | ||||

| EMBP | Executive Management Bonus Plan | ||||

| ERG | Employee Resource Group | ||||

| ESG | Environmental, Social and Governance | ||||

| ESPP | Employee Stock Purchase Plan | ||||

| Exchange Act | Securities Exchange Act of 1934 | ||||

| FASB | Financial Accounting Standards Board | ||||

| GAAP | U.S. Generally Accepted Accounting Principles | ||||

| Incentive Adjusted EBIT | Incentive Adjusted Earnings (Loss) Before Interest and Income Taxes (a non-GAAP financial measure) | ||||

| Incentive Adjusted ROIC | Incentive Adjusted Return on Invested Capital (a non-GAAP financial measure) | ||||

| Investor Relations Website | Our investor relations website at investor.nordstrom.com | ||||

| IRC | Internal Revenue Code | ||||

| LTI | Long-Term Incentives | ||||

| NDCP | Nordstrom Deferred Compensation Plan | ||||

| NEO | Named Executive Officer | ||||

| Notice | Notice of Annual Meeting of Shareholders | ||||

| NYSE | New York Stock Exchange | ||||

| PEO | Principal Executive Officer | ||||

| Plan Trustee | Bank of New York Mellon, as trustee of the Nordstrom 401(k) Plan | ||||

| PSU | Performance Share Unit | ||||

| Record Date | March 13, 2024 | ||||

| RSU | Restricted Stock Unit | ||||

| SEC | Securities and Exchange Commission | ||||

| Semler Brossy | Semler Brossy Consulting Group, LLC | ||||

| SERP | Supplemental Executive Retirement Plan | ||||

| TC | Technology Committee of the Board | ||||

| TSR | Total Shareholder Return | ||||

| 2024 Proxy Statement | 6 | ||||||||||||

| The Board recommends a vote “FOR” each of the Board’s twelve nominees. | ||||

| Committee Memberships | ||||||||||||||||||||||||||

| Name | Age | Independent | Director Since | Professional Highlights | AFC | CGNC | CPCC | TC | ||||||||||||||||||

| Stacy Brown-Philpot | 48 | ü | 2017 | Founder & Managing Partner, Cherryrock Capital | M, F | C | ||||||||||||||||||||

| James L. Donald | 70 | ü | 2020 | Co-Chairman, Albertsons Companies | M, F | C | ||||||||||||||||||||

| Kirsten A. Green | 52 | ü | 2019 | Founder & Managing Partner, Forerunner Ventures | M, F | M | ||||||||||||||||||||

| Glenda G. McNeal | 63 | ü | 2019 | Chief Partner Officer, American Express | C | M | ||||||||||||||||||||

| Erik B. Nordstrom | 60 | 2006 | Chief Executive Officer, Nordstrom | |||||||||||||||||||||||

| Peter E. Nordstrom | 62 | 2006 | President & Chief Brand Officer, Nordstrom | |||||||||||||||||||||||

| Amie Thuener O’Toole | 49 | ü | 2022 | Vice President and Chief Accounting Officer, Alphabet | C, F | M | ||||||||||||||||||||

| Guy B. Persaud | 53 | ü | 2023 | President, New Business Unit, Procter & Gamble | ||||||||||||||||||||||

| Eric D. Sprunk | 60 | ü | 2023 | Former COO, Nike | M | M | ||||||||||||||||||||

Bradley D. Tilden Chairman of the Board | 63 | ü | 2016 | Chairman of the Board, Nordstrom, Former Chairman and CEO, Alaska Air Group | M | |||||||||||||||||||||

| Mark J. Tritton | 60 | ü | 2020 | Former President and CEO, Bed Bath & Beyond | M | M | ||||||||||||||||||||

| Atticus N. Tysen | 58 | ü | 2023 | SVP, Product Development, Chief Information Security and Fraud Prevention Officer, Intuit | M | M | ||||||||||||||||||||

C | Committee Chair | |||||||||||||||||||||||||

M | Committee Member | |||||||||||||||||||||||||

| F | Financial Expert | |||||||||||||||||||||||||

| 7 | 2024 Proxy Statement |  | ||||||||||||

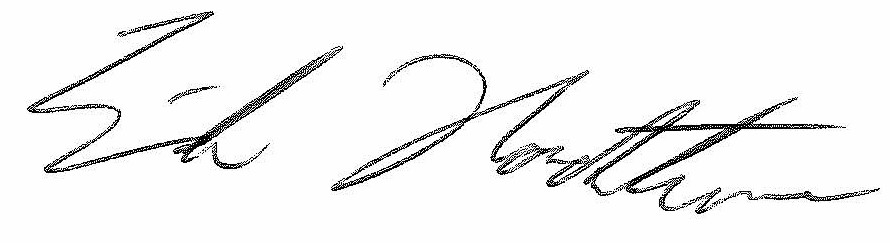

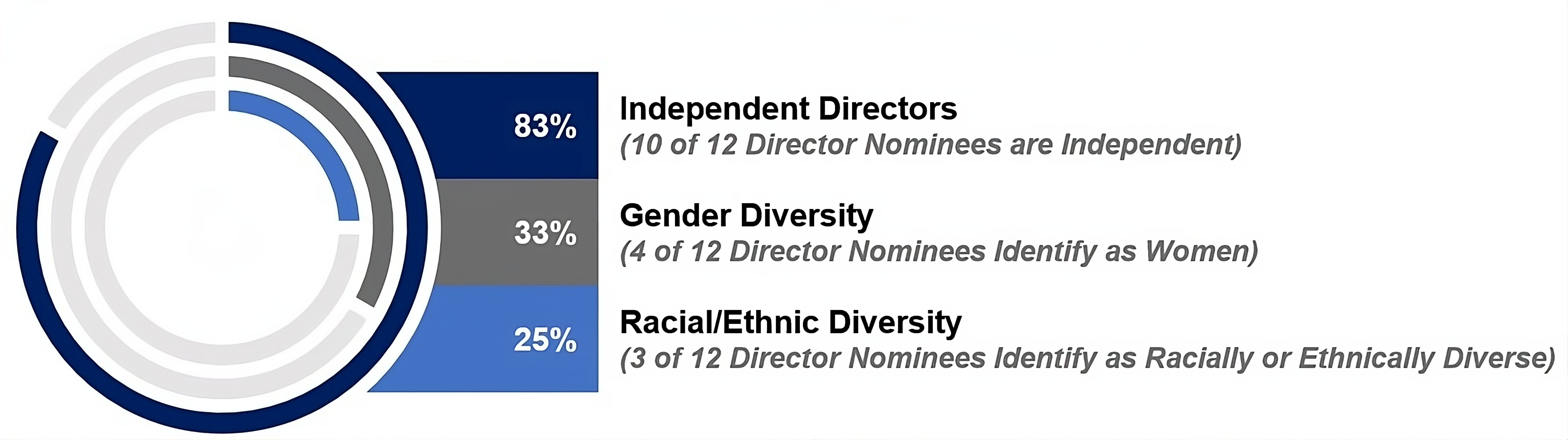

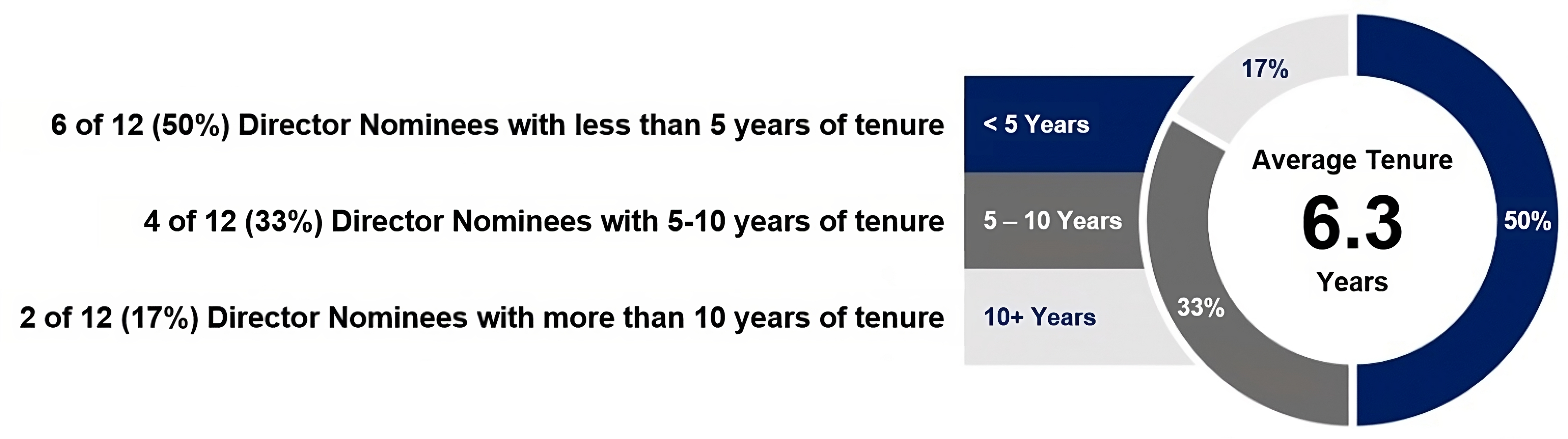

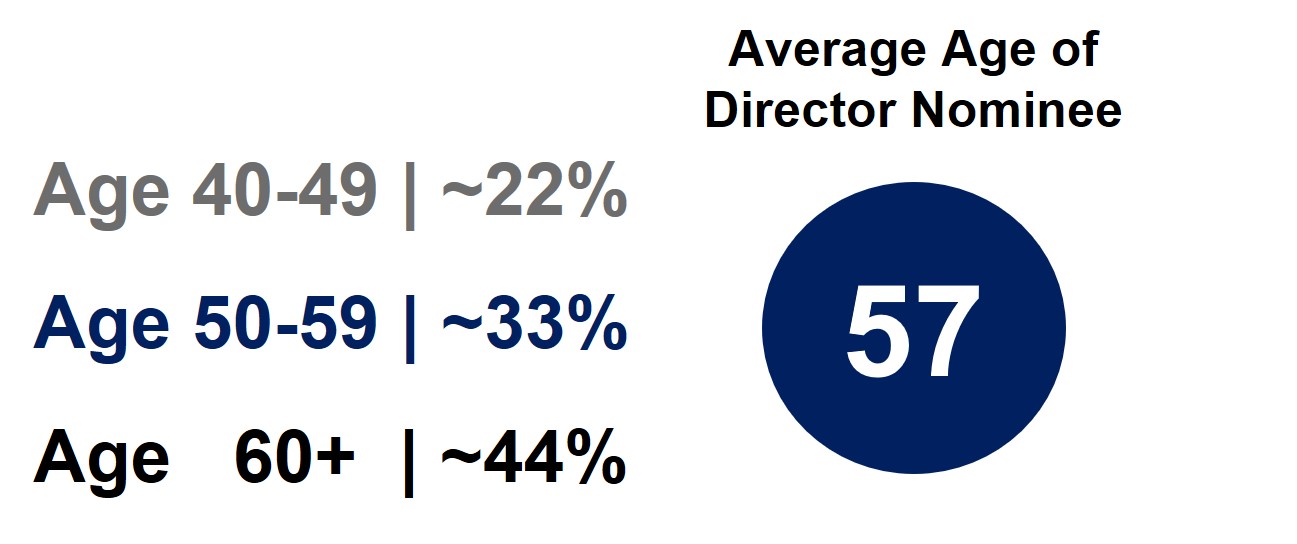

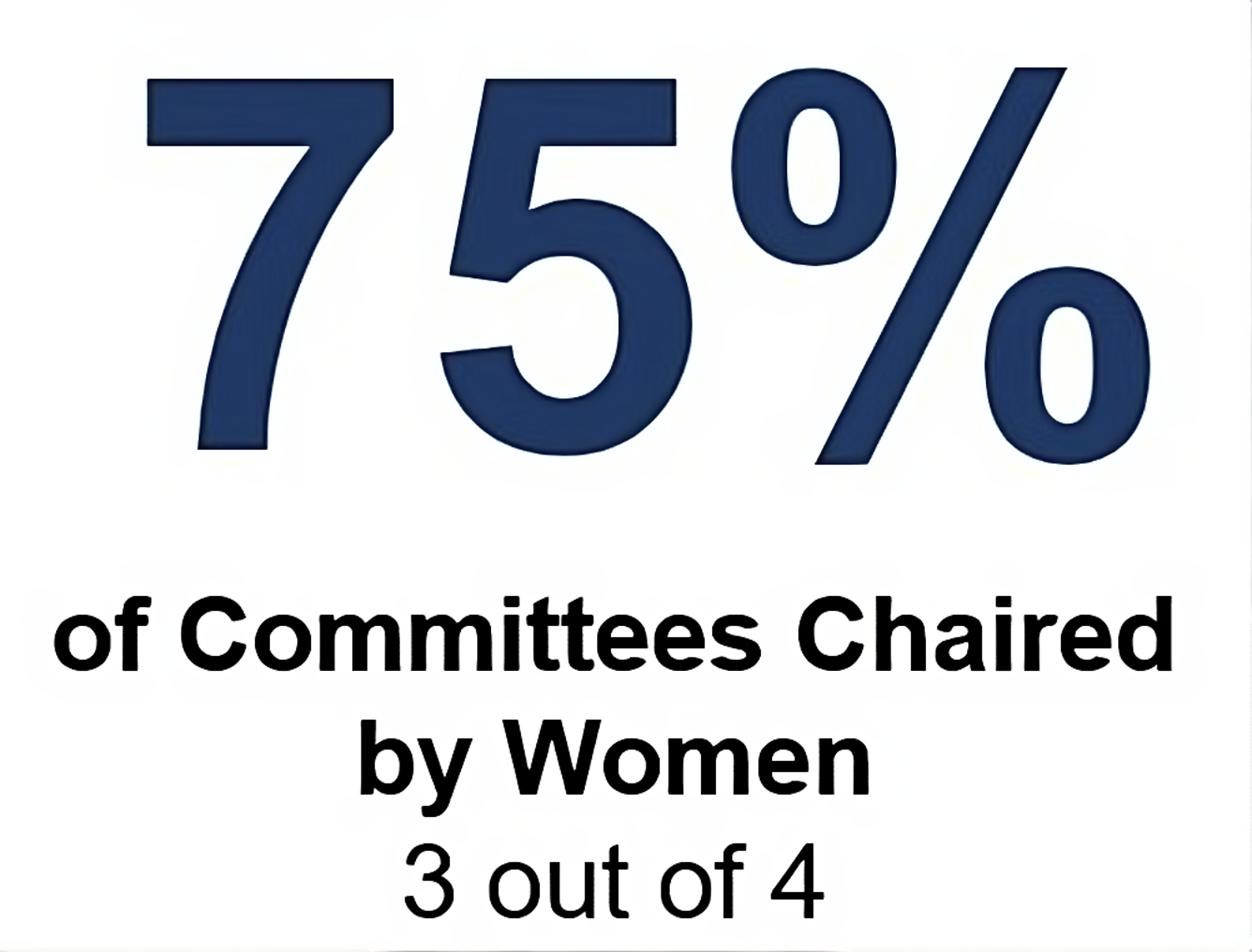

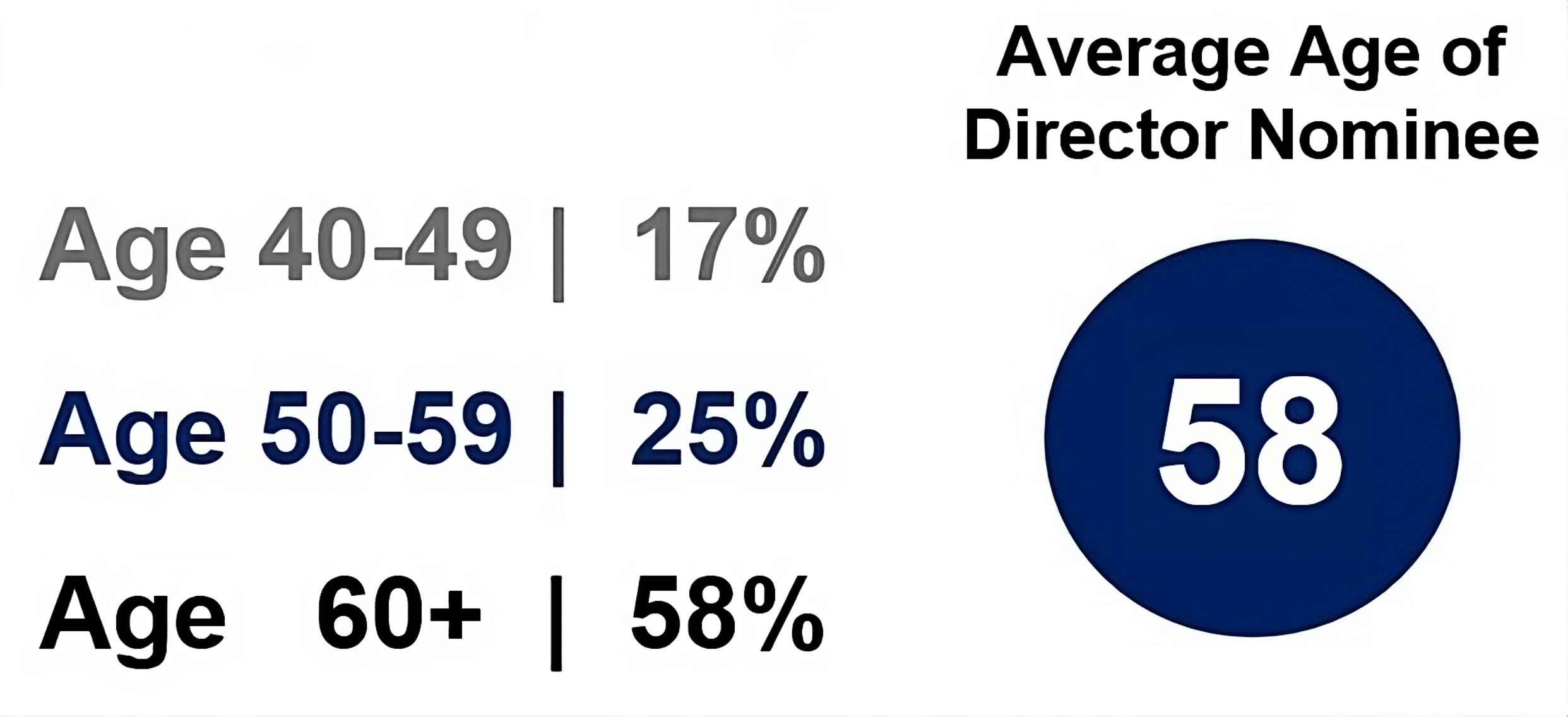

| Our Director Nominee Demographics | ||

| ||

| ||

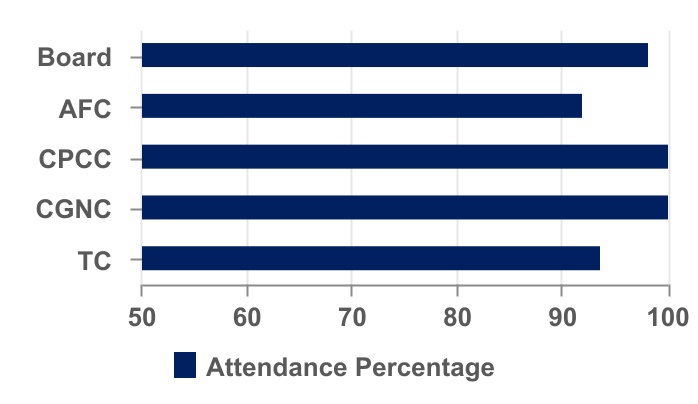

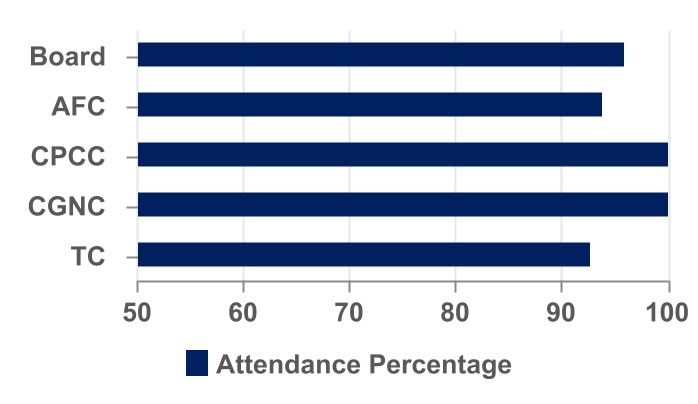

| Board Attendance | Board Committees Chaired by Women | |||||||||||||||||||

|   | |||||||||||||||||||

| |||||||||||||||||

| Relevant Skills and Experience | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The nominees possess a balance of leadership experiences, diverse perspectives, strategic skill sets and professional expertise that are essential in furthering our business strategy and objectives, including: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retail Industry |  | Business Transformation |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Marketing & Customer Experience |  | CEO Experience |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Online Scale & Growth |  | Financial Expertise |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Risk & Crisis Management |  | Technology Expertise |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Board Refreshment | Nominee Age | |||||||

|  | |||||||

| Relevant Skills and Experience | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Our Board’s nominees possess a balance of leadership experiences, diverse perspectives, strategic skill sets and professional expertise that is essential in furthering our business strategy and objectives, including: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retail Industry |  | CEO Experience |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Marketing & Customer Experience |  | Financial Expertise |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10 | 10 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Online Scale & Growth |  | Technology Expertise |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 11 | 7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Risk & Crisis Management |  | Diversity, Equity, Inclusion & Belonging |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Business Transformation |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Board recommends a vote “FOR” this proposal. | ||||

| 9 | 2024 Proxy Statement |  | ||||||||||||

| The Board recommends a vote “FOR” this proposal. | ||||

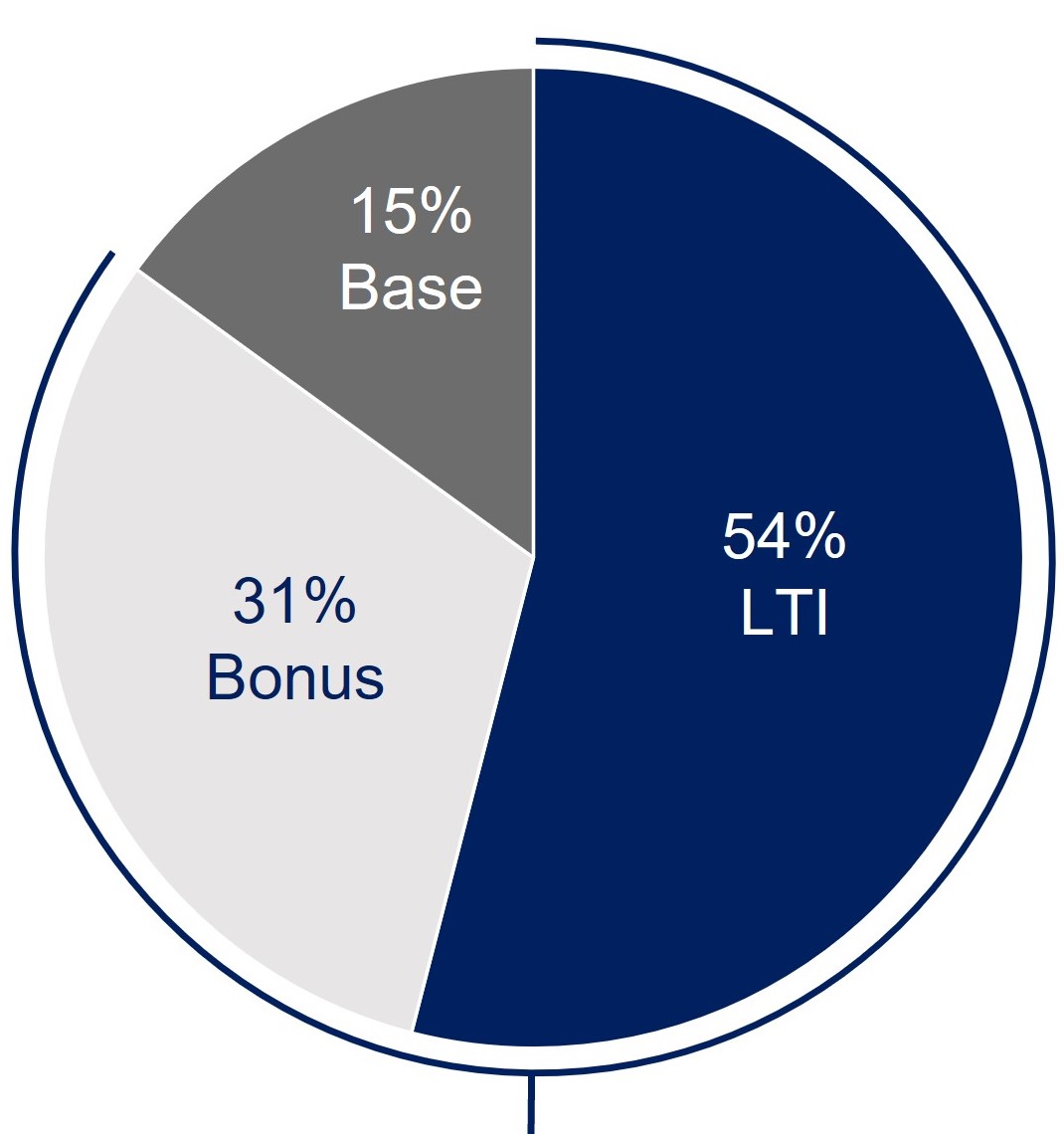

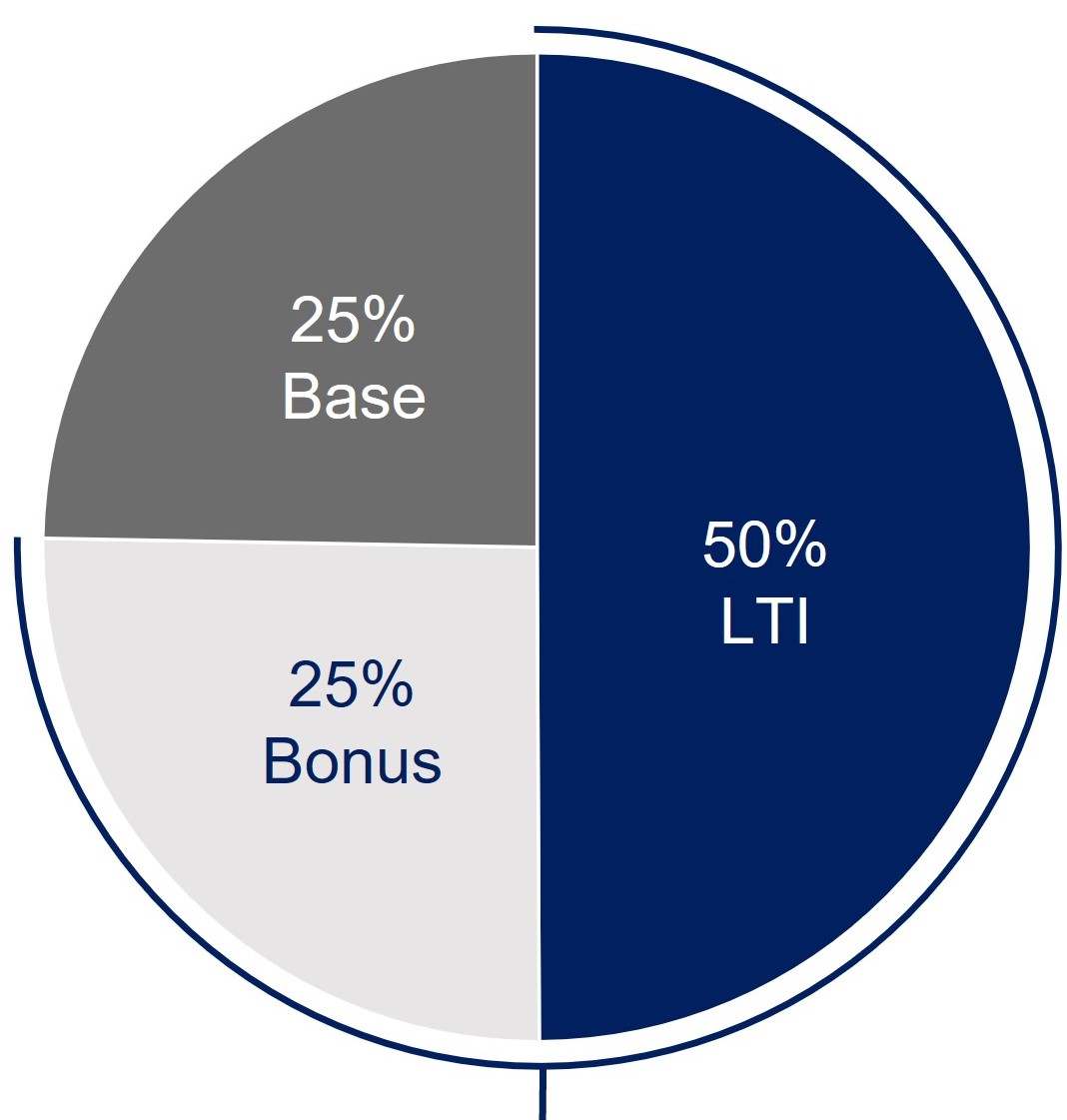

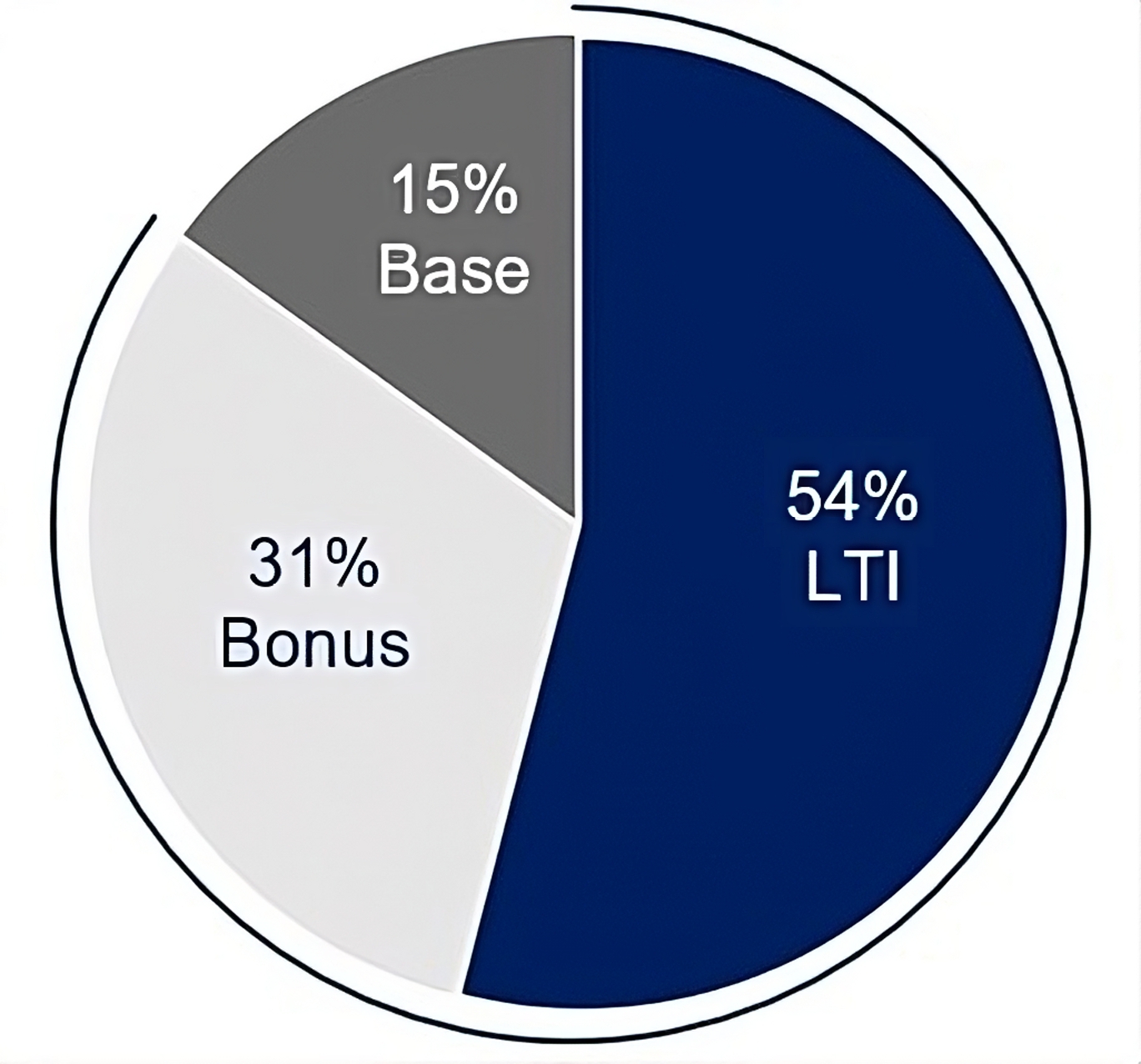

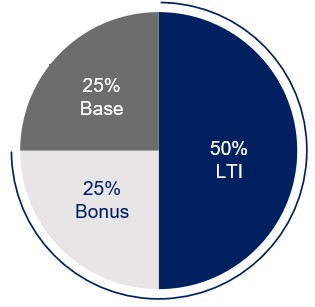

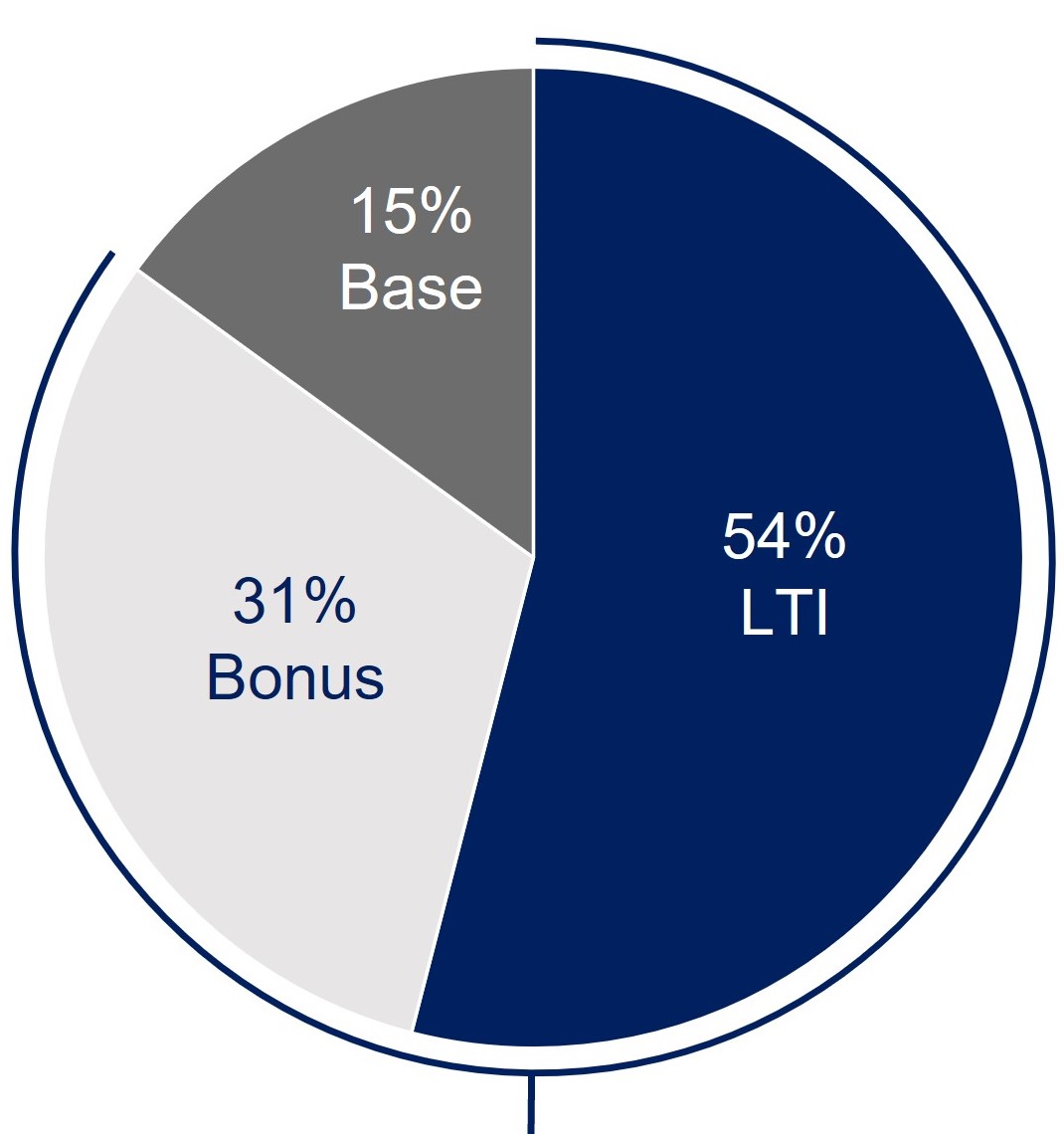

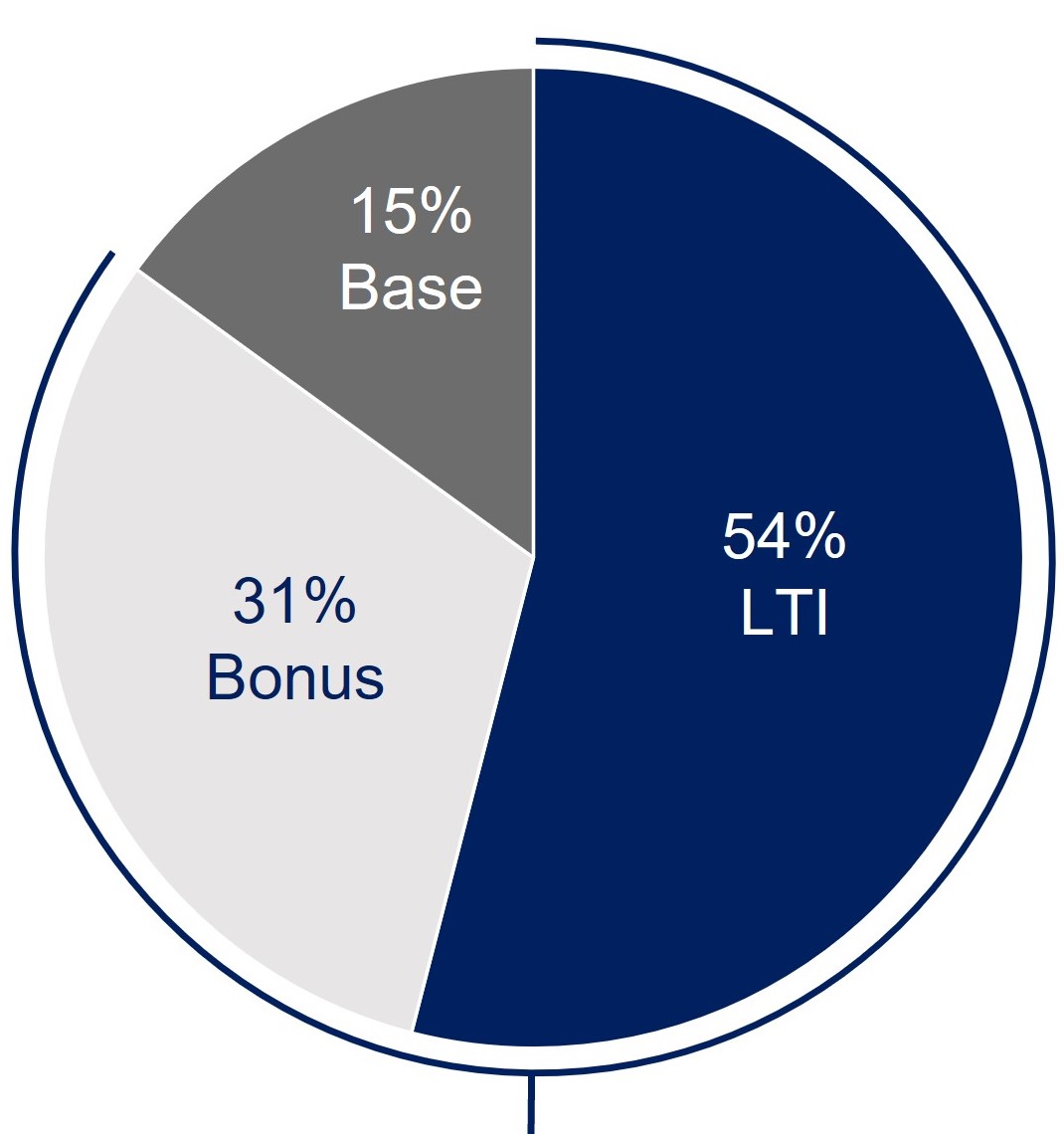

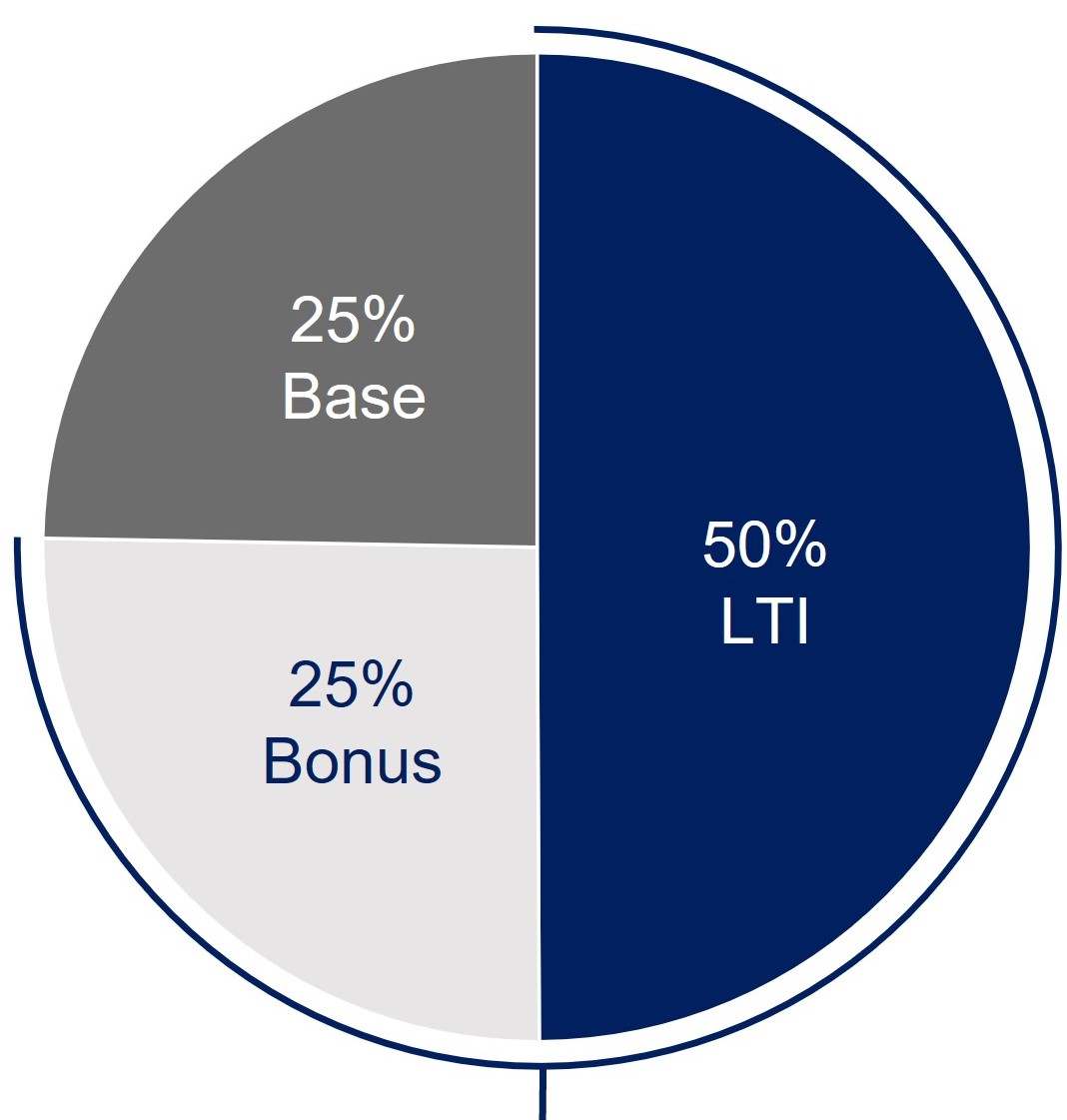

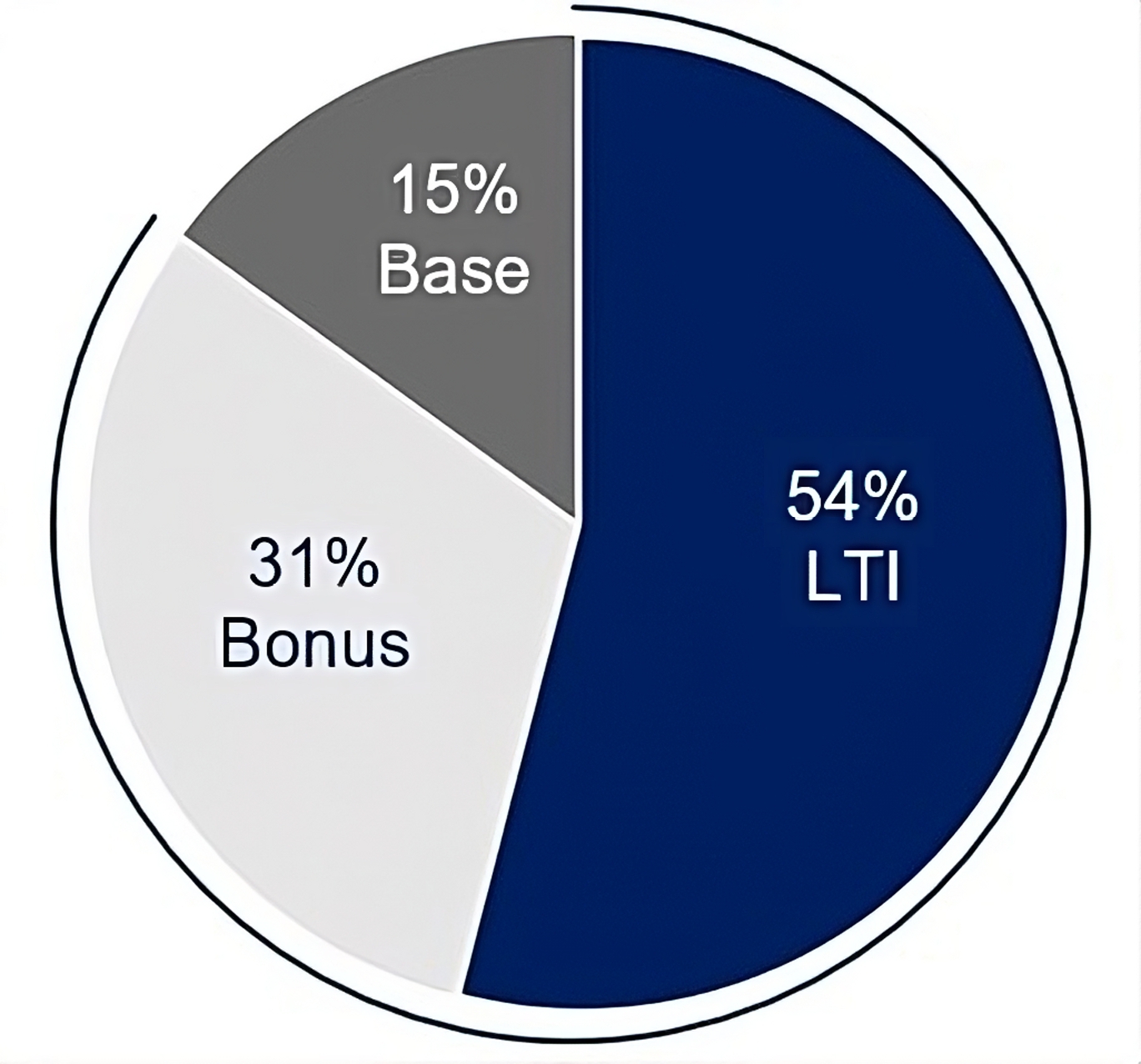

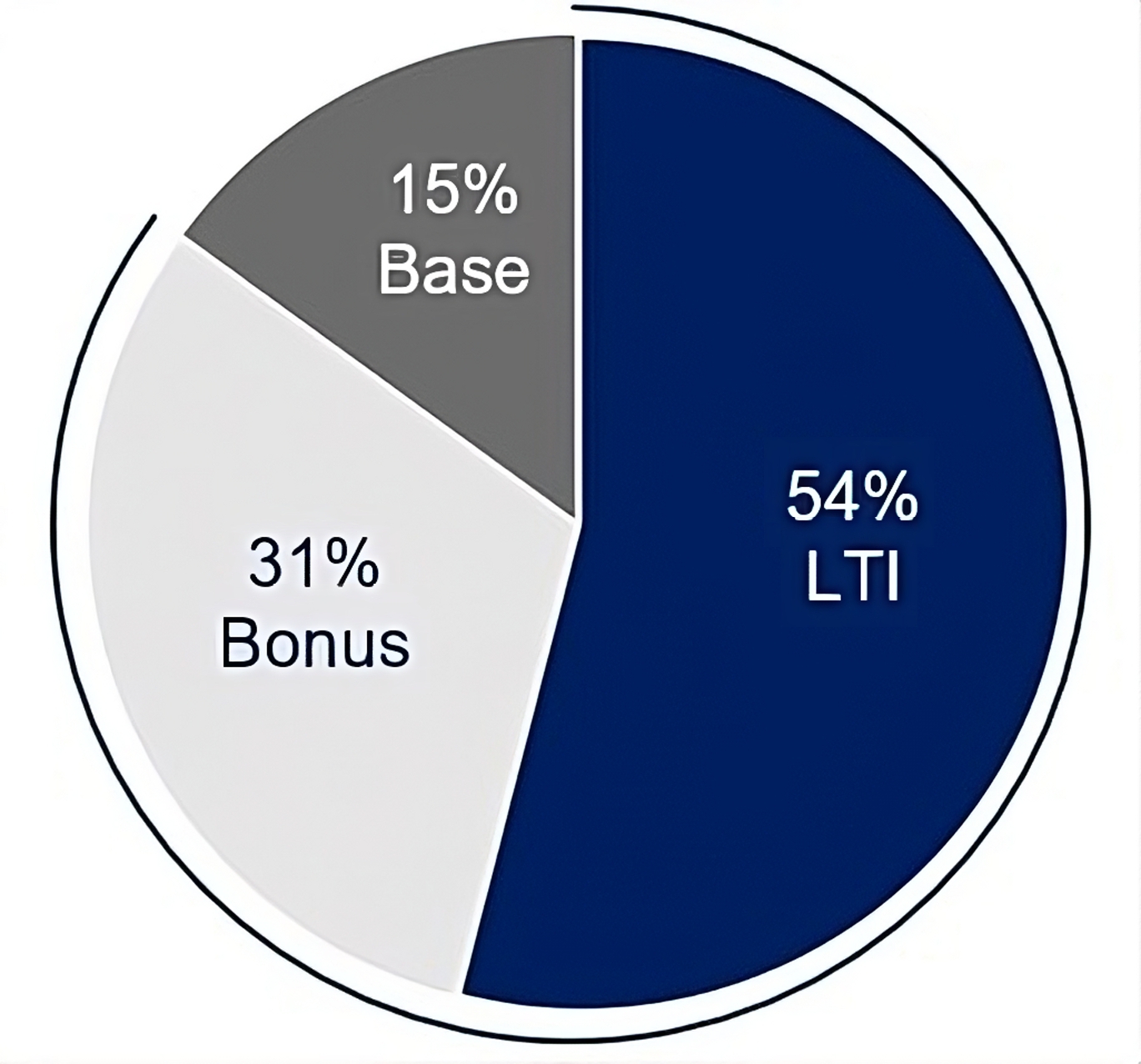

| CEO and President & Chief Brand Officer | Average of all Other NEOs | ||||

|  | ||||

| 85% | 75% | ||||

| Performance Based | Performance Based | ||||

| CEO and President & Chief Brand Officer | Average of All Other NEOs | ||||

|  | ||||

| 85% | 75% | ||||

| Performance-Based | Performance-Based | ||||

| ||||||||||||||

Director Compensation and Stock Ownership Guidelines | |||||

| 11 | 2024 Proxy Statement |  | ||||||||||||||||||

| |||||||||||||||||

| Corporate Governance | ✓ | 10 of 12 Director Nominees are Independent | ✓ | Independent Chairman | ||||||||||

| ✓ | Regular Executive Session of Independent Directors | ✓ | Committees Comprised Only of Independent Directors | |||||||||||

| ✓ | The majority of Audit & Finance Committee Members are SEC “Audit Committee Financial Experts” | ✓ | Annual Evaluations of Board, Committees and Directors | |||||||||||

| ✓ | Authority to Hire Independent Consultants and Experts | ✓ | Our Only Class of Voting Shares Is Our Common Stock | |||||||||||

| Shareholder Rights | ✓ | Annual Election of All Directors | ✓ | Majority Vote Standard for Uncontested Director Elections | ||||||||||

| ✓ | Each Share of Common Stock Is Entitled to One Vote | ✓ | Shareholders of 10%+ Entitled to Call Special Meetings | |||||||||||

| ✓ | Annual Say-on-Pay Advisory Vote | ✓ | Open Communications with Directors | |||||||||||

| ✓ | Regular Outreach to and Engagement of Shareholders | |||||||||||||

| Compensation | ✓ | Pay-for-Performance Philosophy Guides Executive Compensation | ✓ | Stock Ownership Policy for Directors and Executive Officers | ||||||||||

| ✓ | Clawback Policy | ✓ | Hedging and Pledging Policies | |||||||||||

| ✓ | Independent Compensation Consultant Engaged by the CPCC | |||||||||||||

| Strategy and Risk | ✓ | Company Strategy Oversight by Board | ✓ | Risk Oversight by Board and Committees Aligned with Company Strategy | ||||||||||

| ✓ | Regular Risk Management Reports to Board and Committees | ✓ | Compensation Program Designed to Reduce Undue Risk | |||||||||||

| ✓ | Annual Strategy Planning Meeting | ✓ | Board Oversight of Chief Executive Officer and Management Succession Planning | |||||||||||

| 13 | 2024 Proxy Statement |  | ||||||||||||||||||

| We are a company built on the trust of our customers, employees, business partners and stakeholders. | ||

| 2024 Proxy Statement | 14 | ||||||||||||

| Our Board views effective oversight and management of ESG issues as vital to the Company’s long-term growth. | ||

| 15 | 2024 Proxy Statement |  | ||||||||||||

| ||||||||||||||

| 2024 Proxy Statement | 16 | ||||||||||||

| Audit and Finance Committee | ||

The Audit and Finance Committee provides financial oversight of the | |||||

| 17 |  | ||||||||||||||||

| Compensation, People and Culture Committee | ||

| Our Compensation, People and Culture Committee oversees our strategies and goals relating to the development of our employees throughout the organization. | ||

| Corporate Governance and Nominating Committee | ||

| Our Corporate Governance and Nominating Committee regularly reviews best practices to ensure the proper functioning of the Board and its Committees. | ||

| ||||||||||||||

| Technology Committee | ||

| 19 |  | ||||||||||||||||

| Non-Employee Director Annual Compensation Elements for | Amount ($)* | ||||

| Director Retainer | 85,000 | ||||

| AFC Chair Retainer | 30,000 | ||||

| CPCC Chair Retainer | 20,000 | ||||

| CGNC Chair Retainer | 15,000 | ||||

| TC Chair Retainer | 15,000 | ||||

| Grant Date Value of Director Equity Grant of Common Stock | 150,000 | ||||

| Grant Date Value of Chairman of the Board Equity Grant of Common Stock | 200,000 | ||||

| Our Directors are required to hold stock having a value of at least $450,000 | ||

| Changes for | ||

| 2024 Proxy Statement | 20 | ||||||||||||

| Non-Employee Director Summary Compensation Table | ||

| Name | Fees Earned or Paid in Cash ($)(a)(b) | Stock Awards ($)(b)(c) | All Other Compensation ($)(d) | Total ($) | ||||||||||

| Shellye L. Archambeau | 100,000 | 149,994 | 2,049 | 252,043 | ||||||||||

| Stacy Brown-Philpot | 100,000 | 149,994 | 8,545 | 258,539 | ||||||||||

| Tanya L. Domier* | — | — | 18,175 | 18,175 | ||||||||||

| James L. Donald | 85,000 | 149,994 | 9,924 | 244,918 | ||||||||||

| Kirsten A. Green | 85,000 | 149,994 | 581 | 235,575 | ||||||||||

| Glenda G. McNeal | 85,000 | 149,994 | 27,052 | 262,046 | ||||||||||

| Brad D. Smith | 85,000 | 349,997 | 6,110 | 441,107 | ||||||||||

| Bradley D. Tilden | 115,000 | 149,994 | 4,934 | 269,928 | ||||||||||

| Mark J. Tritton | 105,000 | 149,994 | 12,282 | 267,276 | ||||||||||

| Name | Retainers Earned or Paid in Cash ($)(a)(b) | Stock Awards ($)(b)(c) | All Other Compensation ($)(d) | Total ($) | ||||||||||

| Stacy Brown-Philpot | 100,000 | 149,987 | 4,879 | 254,866 | ||||||||||

| James L. Donald | 105,000 | 149,987 | 18,028 | 273,015 | ||||||||||

| Kirsten A. Green | 85,000 | 149,987 | 17,654 | 252,641 | ||||||||||

| Glenda G. McNeal | 100,000 | 149,987 | 42,447 | 292,434 | ||||||||||

| Amie Thuener O’Toole | 115,000 | 149,987 | 10,842 | 275,829 | ||||||||||

| Guy B. Persaud | 42,500 | 74,994 | — | 117,494 | ||||||||||

| Eric D. Sprunk | 85,000 | 149,987 | 17,168 | 252,155 | ||||||||||

| Bradley D. Tilden | 85,000 | 349,987 | 6,367 | 441,354 | ||||||||||

| Mark J. Tritton | 85,000 | 149,987 | 4,655 | 239,642 | ||||||||||

| Atticus N. Tysen | 106,250 | 187,480 | 3,709 | 297,439 | ||||||||||

| ||||||||||||||

| 21 | 2024 Proxy Statement |  | ||||||||||||

| 2024 Proxy Statement | 22 | ||||||||||||

| Driving Equity | ||

| Creating an Inclusive Culture | ||

| We are committed to creating a culture where employees feel they can bring their whole selves to work. | ||

| Strengthening Our Talent Pipeline | ||

| 23 | 2024 Proxy Statement |  | ||||||||||||

| Our values have long served as a north star for our Company — they are deeply embedded in the way we do business and guide the decisions we make, the partnerships we form and the causes we support. | ||

| ||

| Respecting Human Rights | ||

| 2024 Proxy Statement | 24 | ||||||||||||

| Investing in Our Communities | ||

|  | ||||

|  | ||||

| Awards | ||

| 25 | 2024 Proxy Statement |  | ||||||||||||||||||

| ||||||||||||||

| PROPOSAL 1: | ELECTION OF DIRECTORS | ||||

| The Board recommends a vote “FOR” each of the Board’s twelve nominees. | ||||

| Director Qualifications, Experience and Nominating Process | ||

| DESIRED SKILL | NORDSTROM BUSINESS CHARACTERISTICS | WHAT THE SKILL REPRESENTS | ||||||||||||

| Retail Industry | We are a leading fashion retailer devoted to helping customers feel good and look their best. | Large national-scale retail company experience. | |||||||||||

| Marketing & Customer Experience | As customer expectations change, we must evolve our core value of providing excellent customer service to meet customers on their terms. | Expertise in customer service and background in marketing leadership. | |||||||||||

| Online Scale & Growth | Over the past several years, we have made investments to transform into | Experience leveraging online platforms to grow and scale business. | |||||||||||

| Risk & Crisis Management | With a large workforce and operations across the United States, | Experience helping organizations navigate fast-paced and dynamic situations involving emerging risks and crises. | |||||||||||

| Business Transformation | In our effort to give customers the most relevant products, we are changing the way we’ve historically thought about our business model – developing and entering into novel arrangements with brands around the world to give our customers more choices than ever before. | Expertise in overseeing the transformation of business in a dynamic, ever-changing industry. | |||||||||||

| CEO Experience | With more than 350 retail locations across the United States, | Experience as a Chief Executive Officer. | |||||||||||

| Financial Expertise | We are a large public company requiring complex financial forecasts, reporting and other business considerations. | Ability to understand financial data and use that data to make decisions around business strategy. | |||||||||||

| Technology Expertise | We are continually investing in technology to enhance the customer experience. | Demonstrated leadership and expertise relating to digital platforms, information technology, data security and/or data analytics. | |||||||||||

| Diversity, Equity, Inclusion and Belonging | Our commitment to fostering a diverse, equitable, and inclusive environment is key to our mission of helping our customers feel good and look their best. | Demonstrated leadership and experience relating to DEIB related matters. | |||||||||||

| |||||||||||||||||

| Nominee Characteristics | ||

| Director Nominees | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stacy Brown-Philpot | James L. Donald | Kirsten A. Green | Glenda G. McNeal | Erik B. Nordstrom | Peter E. Nordstrom | Amie Thuener | Guy B. Persaud | Eric D. Sprunk | Bradley D. Tilden | Mark J. Tritton | Atticus N. Tysen | Totals | ||||||||||||||||||||||||||||||||||||||||||||

| Retail Industry | l | l | l | l | l | l | l | l | |||||||||||||||||||||||||||||||||||||||||||||||

| Marketing & Customer Experience | l | l | l | l | l | l | l | l | l | 10/12 | |||||||||||||||||||||||||||||||||||||||||||||

| Online Scale & Growth | l | l | l | l | l | l | l | l | l | l | 11/12 | ||||||||||||||||||||||||||||||||||||||||||||

| Risk & Crisis Management | l | l | l | l | l | l | l | l | l | ||||||||||||||||||||||||||||||||||||||||||||||

| Business Transformation | l | l | l | l | l | l | l | l | l | l | 11/12 | ||||||||||||||||||||||||||||||||||||||||||||

| CEO Experience | l | l | l | l | l | 5/ | |||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Expertise | l | l | l | l | l | l | l | l | l | 10/12 | |||||||||||||||||||||||||||||||||||||||||||||

| Technology Expertise | l | l | l | l | l | l | l | ||||||||||||||||||||||||||||||||||||||||||||||||

| l | l | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gender | Woman | Man | Woman | Woman | Man | Man | Woman | Man | Man | Man | Man | Man | 4/12 Women | |||||||||||||||||||||||||||||||||||||||||||

| Racially/Ethnically Diverse | Black | White | White | Black | White | White | White | White | White | White | White | 3/12 Diverse | ||||||||||||||||||||||||||||||||||||||||||||

| 27 | 2024 Proxy Statement |  | ||||||||||||||||||

| Stacy Brown-Philpot Skills and Qualifications Ms. Brown-Philpot brings to the Board innovation, operational and entrepreneurial experience, digital, branding and marketing expertise, as well as financial and accounting skills. She provides unique insights to elevate the consumer experience in a global digital economy, as well as needed insights into the attraction and retention of technology talent, with a particular emphasis on technology talent from underrepresented communities. Her service on the board of HP, Inc. provides her with experience in corporate governance matters and key skills in working with directors, understanding board processes and functions, assessing risk and overseeing management. | ||||||||||

Independent Director Joined the Board: 2017 |          | ||||||||||

| Age | Career Highlights •2023 to present: Founder and Managing Partner of Cherryrock Capital, a venture capital firm •2016 to 2020: Chief Executive Officer of TaskRabbit, Inc., a digital home services labor platform company •2013 to 2016: Chief Operating Officer of TaskRabbit, Inc. •2012: Entrepreneur-in-Residence at Google Ventures, the venture capital investment arm of Alphabet, Inc. •Prior to 2012: | ||||||||||

| Nordstrom Board Committee Memberships | |||||||||||

| AFC | |||||||||||

| Other Current Public Boards | Previous Public Boards in Past 5 Years | ||||||||||

| HP, Inc. (since 2015) | None | ||||||||||

| What Nordstrom products help you feel good and look your best? | |||||||||||

| A wrap dress or a sweater and jeans that fit well! | |||||||||||

| James L. Donald Skills and Qualifications Mr. Donald brings to the | ||||||||||

Independent Director Joined the Board: 2020 |          | ||||||||||

| Age | Career Highlights •2019 to present: Co-Chairman of the Board for Albertsons Companies, one of the largest food and drug retailers in the United States •2019: Chief Executive Officer of Albertsons •2018: President and Chief Operating Officer of Albertsons •2013 to 2015: Chief Executive Officer of Extended Stay America, Inc., one of the largest integrated hotel owner/operators in the United •Prior to 2013: Chief Executive | ||||||||||

| Nordstrom Board Committee Memberships | |||||||||||

| AFC | |||||||||||

| Other Current Public Boards | Previous Public Boards in Past 5 Years | ||||||||||

| Albertsons Companies, Inc. (since 2019) | None | ||||||||||

| What Nordstrom products help you feel good and look your best? | |||||||||||

| A classic blazer. | |||||||||||

| |||||||||||||||||

| Kirsten A. Green Skills and Qualifications Ms. Green brings to the Board extensive experience in consumer and | ||||||||||

Independent Director Joined the Board: 2019 |        | ||||||||||

| Age | Career Highlights •2010 to present: Founder and Managing Partner of Forerunner Ventures, •Prior to 2010: Equity Research Analyst at Banc of America Securities; Senior Associate at Deloitte & Touche LLP | ||||||||||

| Nordstrom Board Committee Memberships | |||||||||||

| Other Current Public Boards | Previous Public Boards in Past 5 Years | ||||||||||

| None | Northern Star Investment Corp. II (2021 to 2023) Northern Star Investment Corp. IV (2021 to 2023) Hims and Hers Health, Inc. | ||||||||||

| What Nordstrom products help you feel good and look your best? | |||||||||||

| Versatile pieces I can wear in meetings during the day, as well as out to events and dinners in the evenings. | |||||||||||

| Glenda G. McNeal Skills and Qualifications Ms. McNeal brings to the Board extensive experience in business development, innovation and customer relationship management, as well as financial, accounting and senior leadership skills. Ms. McNeal provides unique insights on strategic planning, risk oversight and operational matters. Ms. McNeal’s service on public company boards provides her with experience with corporate governance matters and key skills in working with directors, understanding board processes and functions, and assessing risk and overseeing management. | ||||||||||

Independent Director Joined the Board: 2019 |       | ||||||||||

| Age | Career Highlights • •2017 to 2024: President of Enterprise Strategic Partnerships of American Express, a globally integrated payments company •2011 to 2017: Executive Vice President and General Manager of the Global Client Group of American Express •1989 to 2011: •Prior to 1989: Arthur Andersen, LLP; the investment banking firm of Salomon Brothers, Inc. | ||||||||||

| Nordstrom Board Committee Memberships | |||||||||||

| Other Current Public Boards | Previous Public Boards in Past 5 Years | ||||||||||

| None | RLJ Lodging Trust (2011 to 2022) | ||||||||||

| What Nordstrom products help you feel good and look your best? | |||||||||||

| Elevated, high-quality pieces with a bit of edge and personality. | |||||||||||

| 29 | 2024 Proxy Statement |  | ||||||||||||||||||

| Erik B. Nordstrom Skills and Qualifications Mr. | |||||||||||||

Director Joined the Board: 2006 |           | |||||||||||||

| Age | Career Highlights •2020 to present: Chief Executive Officer of Nordstrom, Inc. •2015 to 2020: Co-President of Nordstrom, Inc. •2014 to 2015: Executive Vice President and President, Nordstrom.com of Nordstrom, Inc. •2006 to 2014: Executive Vice President and President, Stores of Nordstrom, Inc. •2000 to 2006: Executive Vice President, Full-Line Stores of Nordstrom, Inc. •2000: Executive Vice President and Northwest General Manager of Nordstrom, Inc. •1995 to 2000: Co-President of Nordstrom, Inc. •1979 to 1995: Nordstrom Canada Retail, Inc., Nordstrom Canada Holdings, LLC and Nordstrom Canada Holdings II, LLC, which are indirect subsidiaries of the Company, have commenced a wind-down of their business operations, obtaining an Initial Order from the Ontario Superior Court of Justice under the Companies’ Creditor Arrangement Act on March 2, 2023 to facilitate the wind-down in an orderly fashion. Erik Nordstrom served as a director and/or officer of such entities. | |||||||||||||

| Nordstrom Board Committee Memberships | ||||||||||||||

| Other Current Public Boards | Previous Public Boards in Past 5 Years | |||||||||||||

| None | None | |||||||||||||

| What Nordstrom products help you feel good and look your best? | ||||||||||||||

| Outside of the office - high quality athletic wear and a comfortable pair of running shoes. | ||||||||||||||

| Erik Nordstrom and Peter Nordstrom are brothers, great-grandsons of the Company’s founder and the second cousins of James Nordstrom, Jr., Chief | ||||||||||||||

| Peter E. Nordstrom Skills and Qualifications Mr. | ||||||||||

Director Joined the Board: 2006 |       | ||||||||||

| Age | Career Highlights •2020 to present: President •2015 to 2020: Co-President of Nordstrom, Inc. •2006 to 2015: Executive Vice President and President, Merchandising of Nordstrom, Inc. •2000 to 2006: Executive Vice President, Full-Line Stores of Nordstrom, Inc. •2000: Executive Vice President and Director of Full-Line Store Merchandise Strategy of Nordstrom, Inc. •1995 to 2000: Co-President of Nordstrom, Inc. •1978 to 1995: | ||||||||||

| Nordstrom Board Committee Memberships | |||||||||||

| Other Current Public Boards | Previous Public Boards in Past 5 Years | ||||||||||

| None | None | ||||||||||

| What Nordstrom products help you feel good and look your best? | |||||||||||

| Too many to count and list! | |||||||||||

| Erik Nordstrom and Peter Nordstrom are brothers, great-grandsons of the Company’s founder and the second cousins of James Nordstrom, Jr., Chief | |||||||||||

| |||||||||||||||||

| Amie Thuener O’Toole Skills and Qualifications Ms. Thuener O’Toole brings to the Board more than 25 years of finance and accounting experience. Her experience in a variety of senior leadership roles at some of the world’s most innovative companies brings valuable perspectives in finance and accounting matters, including financial planning and reporting, risk assessment, incentive compensation plans and finance advice and support for all mergers and acquisitions activities. She brings to the Board a wealth of knowledge and expertise regarding strategic finance in the context of a rapidly growing and quickly-changing business. | ||||||||||

Independent Director Joined the Board: 2022 |        | ||||||||||

| Age | Career Highlights •2018 to present: Vice President and Chief Accounting Officer of Alphabet Inc., one of the world’s leading technology conglomerate holding companies •2013 to 2018: Vice President and Chief Accountant of Alphabet Inc. •1996 to 2012: Managing Director, Transaction Services of PricewaterhouseCoopers | ||||||||||

| Nordstrom Board Committee Memberships | |||||||||||

| Other Current Public Boards | Previous Public Boards in Past 5 Years | ||||||||||

| None | None | ||||||||||

| What Nordstrom products help you feel good and look your best? | |||||||||||

| Shoes! | |||||||||||

| Guy B. Persaud Skills and Qualifications Mr. Persaud brings to the Board more than 15 years of leadership experience in the consumer retail industry and a track record of identifying and operating high-growth and value-creation business opportunities outside of Procter & Gamble’s traditional business units. He has a unique track record of delivering outstanding shareholder return and driving large-scale transformations in a wide range of business and cultural contexts, successfully leading businesses in key global markets such as the U.S., China, Europe, and Latin America. He has significant experience in marketing and brand management, as well as operational expertise in key functions that include research and development, sales, supply chain, manufacturing, acquisitions, product innovation and e-commerce. | ||||||||||

Independent Director Joined the Board: 2023 |         | ||||||||||

| Age 53 | Career Highlights •2021 to present: President of New Business Unit of Procter & Gamble, a global consumer goods company •2015 to 2021: Senior Vice President and General Manager of Procter & Gamble Latin America •1995 to 2015: Various roles of increasing responsibility at Procter & Gamble | ||||||||||

| Nordstrom Board Committee Memberships | |||||||||||

| None | |||||||||||

| Other Current Public Boards | Previous Public Boards in Past 5 Years | ||||||||||

| None | None | ||||||||||

| What Nordstrom products help you feel good and look your best? | |||||||||||

| Brushed cotton blazers with great jeans and boots. | |||||||||||

| 31 | 2024 Proxy Statement |  | ||||||||||||

| Eric D. Sprunk Skills and Qualifications Mr. Sprunk brings to the Board more than 25 years of leadership experience in the consumer retail industry and a track record of driving financial performance and large-scale transformations within a complex global business. He has significant experience in marketing, finance and accounting, as well as operational expertise in key functions that include manufacturing, sourcing, sales and procurement, and product development. His service on public company boards provides additional experience with corporate governance matters, assessing risk and overseeing management. | ||||||||||

Independent Director Joined the Board: 2023 |         | ||||||||||

| Age 60 | Career Highlights •2013 to 2020: Chief Operating Officer of Nike Inc., a global apparel company •2008 to 2015: Executive Vice President of Global Product and Merchandising of Nike •2001 to 2008: Executive Vice President of Global Footwear of Nike •1993 to 2001: Various executive roles at Nike, including Vice/General Manager of America’s Region, General Manager of Footwear Europe, Middle East and Africa, and Chief Financial Officer of Europe, Middle East and Africa •1987 to 1993: Certified public accountant at Price Waterhouse | ||||||||||

| Nordstrom Board Committee Memberships | |||||||||||

| CPCC | |||||||||||

| CGNC | |||||||||||

| Other Current Public Boards | Previous Public Boards in Past 5 Years | ||||||||||

| Bombardier Inc. (2021 to present) General Mills, Inc. (2015 to present) | None | ||||||||||

| What Nordstrom products help you feel good and look your best? | |||||||||||

| Sport coats with high-quality dress shirts and denim. | |||||||||||

| Bradley D. Tilden Skills and Qualifications Mr. Tilden brings to the Board executive, operational, strategic planning and financial experience, as well as insights with respect to customer rewards programs in the consumer services industry. Mr. Tilden’s public company board service provides him with experience with corporate governance matters and key skills in working with directors, understanding board processes and functions, assessing risk and overseeing management. | ||||||||||

Independent Director Joined the Board: 2016 |          | ||||||||||

| Age | Career Highlights •2021 to •2014 to 2021: Chairman and Chief Executive Officer of Alaska Air Group, Inc. •2012 to 2014: President and Chief Executive Officer of Alaska Air Group, Inc. •2008 to 2012: President of Alaska Air Group, Inc. •2002 to 2008: Executive Vice President of Finance and Planning of Alaska Air Group, Inc. •2000 to 2008: Chief Financial Officer of Alaska Air Group, Inc. •Prior to 2000: Vice President of Finance at Alaska Air Group, Inc.; PricewaterhouseCoopers | ||||||||||

| Nordstrom Board Committee Memberships | |||||||||||

| Other Current Public Boards | Previous Public Boards in Past 5 Years | ||||||||||

| None | Alaska Air Group, Inc. (2010 to 2022) | ||||||||||

| What Nordstrom products help you feel good and look your best? | |||||||||||

| Well-made jeans with a dress shirt and classic blue blazer. | |||||||||||

| ||||||||||||||

| Mark J. Tritton Skills and Qualifications Mr. Tritton brings to the Board over 30 years of experience in retail and apparel businesses, providing him deep insights into consumer behavior, brand building and operational matters which are key to the Company’s business. In addition, as | ||||||||||

Independent Director Joined the Board: 2020 |            | ||||||||||

| Age | Career Highlights •2019 to •2016 to 2019: Executive Vice President and Chief Merchandising Officer of Target Corporation, an omnichannel retailer selling everyday essentials and fashionable, differentiated merchandise at discounted prices online and through several brand retail storefronts •2009 to 2016: Executive Vice President and Division President of the Nordstrom Product Group of Nordstrom, Inc. | ||||||||||

On April 23, 2023, Bed Bath & Beyond Inc. filed a voluntary Chapter 11 petition with the United States Bankruptcy Court for the District of New Jersey. | |||||||||||

| Nordstrom Board Committee Memberships | |||||||||||

| CPCC | |||||||||||

| CGNC | |||||||||||

| Other Current Public Boards | Previous Public Boards in Past 5 Years | ||||||||||

| None | Bed Bath & Beyond Inc. (2019 to 2022) | ||||||||||

| What Nordstrom products help you feel good and look your best? | |||||||||||

| Stylish footwear and quality skin care products. | |||||||||||

| Atticus N. Tysen Skills and Qualifications Mr. Tysen brings to the Board more than three decades of engineering and information security experience. Mr. Tysen also has a wealth of knowledge and expertise regarding technology, cybersecurity and fraud prevention in the context of a rapidly growing and quickly-changing business. His background will add to the diversity of experience already represented across our Board and help us hone an increasingly important area of focus for the retail industry. | ||||||||||

Independent Director Joined the Board: 2023 |      | ||||||||||

| Age 58 | Career Highlights •2021 to present: Senior Vice President Product Development, Chief Information Security and Fraud Prevention Officer of Intuit Inc., a global provider of business and financial management solutions •2020 to 2021: Senior Vice President, Chief Information Security Officer, Chief Fraud Prevention Officer and Chief Information Officer of Intuit Inc. •2013 to 2020: Senior Vice President and Chief Information Officer of Intuit Inc. | ||||||||||

| Nordstrom Board Committee Memberships | |||||||||||

| AFC | |||||||||||

| TC | |||||||||||

| Other Current Public Boards | Previous Public Boards in Past 5 Years | ||||||||||

| None | None | ||||||||||

| What Nordstrom products help you feel good and look your best? | |||||||||||

| Casual chinos paired with a great shirt. | |||||||||||

| 33 |  | ||||||||||||||||

| Audit and Finance Committee | ||||||||||||||

|   |   |   |  | ||||||||||

| Stacy Brown-Philpot | James L. Donald | Kirsten A. Green | Atticus N. Tysen | |||||||||||

| ||||||||||||||

| PROPOSAL 2: | RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | ||||

| The Board recommends a vote “FOR” this proposal. | ||||

| Audit Fees | ||

| Fiscal Year Ended February 3, 2024 | Fiscal Year Ended January 28, 2023 | ||||||||||||||||||||||

| Type of Fee | ($) | (%) | ($) | (%) | |||||||||||||||||||

Audit Fees(a) | 4,765,000 | 92 | 3,658,000 | 89 | |||||||||||||||||||

Audit-Related Fees(b) | 431,000 | 8 | 389,000 | 9 | |||||||||||||||||||

Tax Fees(c) | — | — | 67,000 | 2 | |||||||||||||||||||

| TOTAL | 5,196,000 | 100 | 4,114,000 | 100 | |||||||||||||||||||

| Fiscal Year Ended January 29, 2022 | Fiscal Year Ended January 30, 2021 | ||||||||||||||||||||||

| Type of Fee | ($) | (%) | ($) | (%) | |||||||||||||||||||

Audit Fees(a) | 3,411,000 | 86 | 3,332,000 | 86 | |||||||||||||||||||

Audit-Related Fees(b) | 465,000 | 12 | 467,000 | 12 | |||||||||||||||||||

Other Fees(c) | 68,000 | 2 | 68,000 | 2 | |||||||||||||||||||

| TOTAL | 3,944,000 | 100 | 3,867,000 | 100 | |||||||||||||||||||

| Pre-Approval Policy | ||

| 35 | 2024 Proxy Statement |  | ||||||||||||

| |||||||||||||||||

| Fanya Chandler | ||||

| Employee since 1991 | |||||

| Age 52 | |||||

| |||||

| |||||

| Alexis DePree | ||||

| Employee since 2020 | |||||

| Age | |||||

Chief Supply Chain Officer | |||||

| Gemma Lionello | ||||

| Employee since 1988 | |||||

| Age 58 | |||||

| |||||

| Jason Morris | ||||

| Employee since 2023 | |||||

| Age 48 | |||||

Chief Technology and Information Officer since May 2023. Prior to Nordstrom, Mr. Morris served as | |||||

| James F. Nordstrom, Jr. | ||||

| Employee since 1986 | |||||

| Age 51 | |||||

| |||||

| ||||||||||||||

| |||||

| |||||

| 37 | 2024 Proxy Statement |  | ||||||||||||

| Lisa Price | ||||

| Employee since 2023 | |||||

| Age 51 | |||||

| |||||

Chief Human Resources Officer since | |||||

| Cathy R. Smith | ||||

| Employee since 2023 | |||||

| Age 60 | |||||

Chief Financial Officer since May 2023.Ms. Smith has more than 30 years of financial leadership experience across multiple industries and organizations. Most recently, she served as the | |||||

| Ann Munson Steines | ||||

| Employee since 2019 | |||||

| Age | |||||

Chief Legal Officer, General Counsel and Corporate Secretary since April 2022. Ms. Steines joined the Company as General Counsel and Corporate Secretary in July 2019. Previously, she was Senior Vice President, Deputy General Counsel and Assistant Secretary for Macy’s, Inc. for approximately ten years. Ms. Steines joined Macy’s, Inc. in 1998 as Assistant Counsel, Employment Law, and rose through positions of increasing responsibility until her appointment as Deputy General Counsel and Assistant Secretary. Prior to Macy’s, Ms. Steines was a Senior Attorney with the Overnite Transportation Company, a subsidiary of Union Pacific Corporation. Ms. Steines began her legal career with Dinsmore & Shohl in Cincinnati, Ohio in 1990 and then practiced law with the law firm of Michael Best & Friedrich in Milwaukee, Wisconsin. | |||||

| Kenneth J. Worzel | ||||

| Employee since 2010 | |||||

| Age | |||||

Chief Customer Officer since April 2022. Previously, he served as Chief Operating Officer from August 2019 to April 2022. From 2018 to August 2019, Mr. Worzel served as Chief Digital Officer, from 2016 to 2019 as President of Nordstrom.com, and from 2010 to 2016, | |||||

| |||||||||||||||||

Compensation, People and Culture Committee Report The CPCC has reviewed and discussed with management the CD&A included in this Proxy Statement. The CPCC believes the CD&A represents the intent and actions of the CPCC with regard to executive compensation and has recommended to the Board that it be included in this Proxy Statement for filing with the SEC. | ||||||||||||||||||||||||||

| Compensation, People and Culture Committee | ||||||||||||||||||||||||||

|   |   |  | |||||||||||||||||||||||

| James L. Donald, Chair | Glenda G. McNeal | Eric D. Sprunk | Mark J. Tritton | |||||||||||||||||||||||

| Table of Contents | ||

| Erik B. Nordstrom | Chief Executive Officer | |||||||

| Chief Financial Officer | ||||||||

| Jason Morris | Chief Technology and Information Officer | |||||||

| Peter E. Nordstrom | President & Chief Brand Officer | |||||||

| Kenneth J. Worzel | Chief Customer Officer | |||||||

| Michael W. Maher | Former Interim Chief Financial Officer and Chief | |||||||

| Executive Summary | ||

| 39 | 2024 Proxy Statement |  | ||||||||||||||||||

| CEO and President & Chief Brand Officer | CEO and President & Chief Brand Officer | Average of All Other NEOs | CEO and President & Chief Brand Officer | Average of All Other NEOs | ||||||

|  |  | ||||||||

| ||||||||||

|  | |||||||||

| 85% | 85% | 75% | 85% | 75% | Performance Based | |||||

| Performance-Based | Performance-Based | |||||||||

| 2024 Proxy Statement | 40 | ||||||||||||

| Performance-Based Annual Cash Bonus | 2019 | 2020 | 2021 | 2022 | 2023 | ||||||||||||

| CEO and President & Chief Brand Officer actual bonus payouts as a % of target | 47% | 0 | % | 128% | 0 | % | 70% | ||||||||||

| Incentive Adjusted EBIT weighting as a % of target | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | |||||||

| Average of all other NEOs actual bonus payouts as a % of target | 56 | % | 0 | % | 128 | % | 0 | % | 65 | % | |||||||

| Incentive Adjusted EBIT weighting as a % of target | 67 | % | 67 | % | 100 | % | 100 | % | 75 | % | |||||||

| Grant Realizable % | 2019 | 2020 | 2021 | 2022 | 2023 | ||||||||||||

| CEO and President & Chief Brand Officer (realizable value as a % of grant value) | 0 | % | 58 | % | 0 | % | 36 | % | 50 | % | |||||||

| Average of all other active NEOs (realizable value as a % of grant value) | 12 | % | 88 | % | 43 | % | 36 | % | 107 | % | |||||||

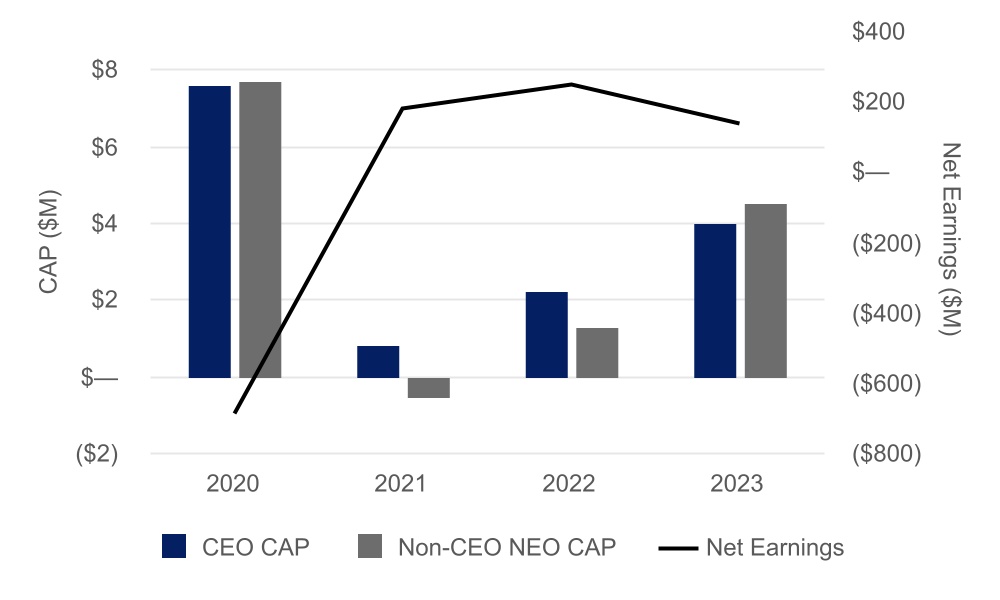

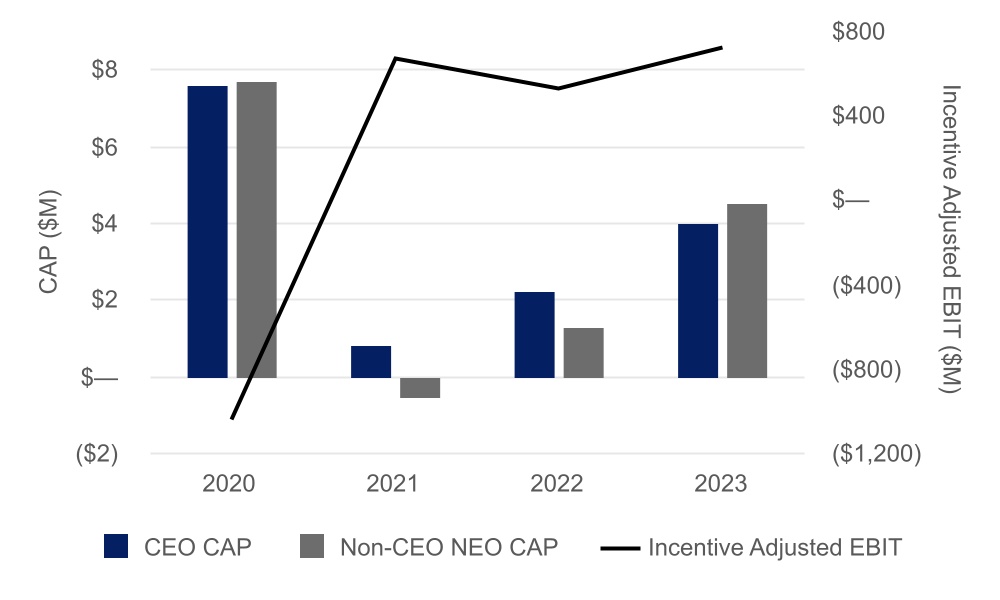

| 2017 | 2018 | 2019 | 2020 | 2021 | ||||||||||||||||||||||||||||

| FINANCIAL RESULTS | ||||||||||||||||||||||||||||||||

| Net Earnings (Loss) | $437 | M | $564 | M | $496 | M | ($690 | M) | $178 | M | ||||||||||||||||||||||

| EBIT | $926 | M | $837 | M | $784 | M | ($1,047 | M) | $492 | M | ||||||||||||||||||||||

| Return on Assets | 5.4 | % | 6.8 | % | 5.1 | % | (7.1 | %) | 1.9 | % | ||||||||||||||||||||||

| INCENTIVE COMPENSATION PAYOUTS | ||||||||||||||||||||||||||||||||

Incentive Adjusted EBIT(a) | $952 | M | $909 | M | $808 | M | ($1,047 | M) | $666 | M | ||||||||||||||||||||||

| Incentive Adjusted ROIC | 10.0 | % | 12.8 | % | 11.2 | % | (8.5 | %) | 7.0 | % | ||||||||||||||||||||||

Annual bonus payout as a % of Target on Incentive Adjusted EBIT measure(b) | 96 | % | 89 | % | 44 | % | 0 | % | 128 | % | ||||||||||||||||||||||

3-year TSR percentile ranking within the S&P 500(c) | 10%ile | 24%ile | 20%ile | N/A | N/A | |||||||||||||||||||||||||||

| PSU vesting (payout as a % of Target) | 0 | % | 0 | % | 0 | % | N/A (d) | 0 | % | |||||||||||||||||||||||

| GRANT REALIZABLE VALUES | 2017 | 2018 | 2019 | 2020 | 2021 | |||||||||||||||||||||||||||

| PSUs (realizable value as a % of grant value) | 0 | % | N/A | 0 | % | N/A | N/A | |||||||||||||||||||||||||

| RSUs (realizable value as a % of grant value) | 93 | % | 64 | % | 71 | % | 112 | % | 66 | % | ||||||||||||||||||||||

| Stock options (realizable value as a % of grant value) | 5 | % | N/A | 0 | % | 95 | % | 0 | % | |||||||||||||||||||||||

| 41 | 2024 Proxy Statement |  | ||||||||||||||||||

| WHAT WE DO | WHAT WE DON’T DO | |||||||||||||

| ü |  | Provide employment agreements. | ||||||||||||

| Offer separation benefits to our NEOs who are Nordstrom family members. | |||||||||||||

| Offer special perquisites to our NEOs. | |||||||||||||

| Maintain separate change in control agreements. | |||||||||||||

| ü | Retain meaningful stock ownership guidelines: Our expectations for ownership align executives’ interests with those of our shareholders, and |  | ||||||||||||

| Issue grants below 100% fair market value. | |||||||||||||

| ü | Mitigate undue risk: We have caps on potential performance-based bonus payments, a |  | ||||||||||||

| ||||||||||||||

| ü | Engage an independent compensation consulting firm: The CPCC’s consultant does not provide any other services to the Company. |  | ||||||||||||

| ü | Apply conservative post-employment and change in control provisions. | |||||||||||||

| ü |  | |||||||||||||

Limit accelerated vesting: Our equity plan provides for accelerated vesting of equity awards after a change in control only if an executive is involuntarily terminated by the Company without cause or resigns for good reason, a provision referred to as a “double trigger.” | ||||||||||||||

| ü |  | |||||||||||||

| ||||||||||||||

Restrict pledging activity: All Executive Officers are subject to pre-clearance requirements and restrictions. | ||||||||||||||

| ü |  | |||||||||||||

Receive strong shareholder support: Each year since 2011, more than 90% of the votes cast have been supportive of our compensation programs. |  | |||||||||||||

| Framework for Executive Compensation | ||

| 2024 Proxy Statement | 42 | ||||||||||||

| Compensation Element | Purpose | |||||||||||||||||

| Base Salary ($) | Performance-Based Annual Cash Bonus (Target Opportunity as a % of Base Salary) | LTI Annual Grant (Target Grant Value as a % of Base Salary) | ||||||||||||||||||||||||||||||||||||

| Name | FYE 2020 | FYE 2021 | FYE 2020 | FYE 2021 | FYE 2020 | FYE 2021 | ||||||||||||||||||||||||||||||||

| Erik B. Nordstrom | 758,500 | 758,500 | 200 | 200 | 350 | 350 | ||||||||||||||||||||||||||||||||

| Anne L. Bramman | 800,000 | 815,000 | 100 | 100 | 200 | 200 | ||||||||||||||||||||||||||||||||

| Peter E. Nordstrom | 758,500 | 758,500 | 200 | 200 | 350 | 350 | ||||||||||||||||||||||||||||||||

| Kenneth J. Worzel | 875,000 | 895,000 | 125 | 125 | 250 | 250 | ||||||||||||||||||||||||||||||||

| Edmond Mesrobian | 775,000 | 800,000 | 80 | 80 | 150 | 150 | ||||||||||||||||||||||||||||||||

| ||||||||||||||

| Milestones | |||||||||||||||||

| Name | Bonus Measures | Threshold | Target | Superior | Actual | ||||||||||||

| All NEOs | Incentive Adjusted EBIT | $375 | M | $612 | M | $900 | M | $666M | |||||||||

| % of Payout | 25 | % | 100 | % | 250 | % | 128 | % | |||||||||

| Subject to Incentive Adjusted ROIC threshold | 5.5% | 7.0 | % | ||||||||||||||

Performance Measures for Performance Period: February 3, 2019 – January 29, 2022 | ||||||||

| Free Cash Flow Growth | EBIT Margin % | Percentage of Units that will Vest | ||||||

| ≥31.4% | ≥7.1% | 200% | ||||||

| 28.9% | 6.8% | 100% | ||||||

| 26.3% | 6.5% | 50% | ||||||

| <26.3% | <6.5% | 0% | ||||||

| ||||||||||||||

| Base Salary ($) | Performance-Based Annual Cash Bonus (Target Opportunity as a % of Base Salary) | LTI Annual Grant (Target Grant Value as a % of Base Salary) | ||||||||||||||||||||||||||||||||||||

| Name | FYE 2022 | FYE 2023 | FYE 2022 | FYE 2023 | FYE 2022 | FYE 2023 | ||||||||||||||||||||||||||||||||

| Erik B. Nordstrom | 758,500 | 758,500 | 200 | 200 | 350 | 350 | ||||||||||||||||||||||||||||||||

| Cathy R. Smith | N/A | 875,000 | N/A | 125 | N/A | 250 | ||||||||||||||||||||||||||||||||

| Jason Morris | N/A | 830,000 | N/A | 80 | N/A | 175 | ||||||||||||||||||||||||||||||||

| Peter E. Nordstrom | 758,500 | 758,500 | 200 | 200 | 350 | 350 | ||||||||||||||||||||||||||||||||

| Kenneth J. Worzel | 895,000 | 895,000 | 125 | 125 | 250 | 250 | ||||||||||||||||||||||||||||||||

| Michael W. Maher | 525,000 | 525,000 | 50 | 50 | 70 | 70 | ||||||||||||||||||||||||||||||||

| 43 | 2024 Proxy Statement |  | ||||||||||||

| Measure and | |||||

| CEO and President & Chief Brand Officer | 100% Incentive Adjusted EBIT | ||||

| Other NEOs | 75% 25% Operational Metric subject to achievement of the | ||||

| Milestones | |||||||||||||||||||||||

| Name | Bonus Measure (a) (b) | Weight | Threshold 25% | Target 100% | Superior 250% | Actual | Total Bonus Payout as a % of Target (c) | ||||||||||||||||

| Erik B. Nordstrom | Incentive Adjusted EBIT | 100 | % | $498M | $858M | $1,258M | $718M | 70 | % | ||||||||||||||

| Total Payout | 70 | % | |||||||||||||||||||||

| Cathy R. Smith | Incentive Adjusted EBIT | 75 | % | $498M | $858M | $1,258M | $718M | 53 | % | ||||||||||||||

| Operational Metric | 25 | % | 19 | % | |||||||||||||||||||

| Total Payout | 72 | % | |||||||||||||||||||||

| Jason Morris | Incentive Adjusted EBIT | 75 | % | $498M | $858M | $1,258M | $718M | 53 | % | ||||||||||||||

| Operational Metric | 25 | % | 19 | % | |||||||||||||||||||

| Total Payout | 72 | % | |||||||||||||||||||||

| Peter E. Nordstrom | Incentive Adjusted EBIT | 100 | % | $498M | $858M | $1,258M | $718M | 70 | % | ||||||||||||||

| Total Payout | 70 | % | |||||||||||||||||||||

| Kenneth J. Worzel | Incentive Adjusted EBIT | 75 | % | $498M | $858M | $1,258M | $718M | 53 | % | ||||||||||||||

| Operational Metric | 25 | % | — | % | |||||||||||||||||||

| Total Payout | 53 | % | |||||||||||||||||||||

| Michael W. Maher | Incentive Adjusted EBIT | 75 | % | $498M | $858M | $1,258M | $718M | — | % | ||||||||||||||

| Operational Metric | 25 | % | — | % | |||||||||||||||||||

| Total Payout | — | % | |||||||||||||||||||||

| 2024 Proxy Statement | 44 | ||||||||||||

| 45 | 2024 Proxy Statement |  | ||||||||||||

| Position | Multiple of Base Salary Used to | ||||||||||

| Chief Executive Officer | 10x | ||||||||||

| Chief Financial Officer | 4x | ||||||||||

| Chief Technology and | 3x | ||||||||||

| President & Chief Brand Officer | 10x | ||||||||||

| Chief Customer Officer | 4x | ||||||||||

| Former Interim Chief Financial Officer | 1x | ||||||||||

| ||||||||||||||

| ||||||||||||||

| Name and Principal Position | Fiscal Year | Salary ($)(a) | Bonus ($)(b) | Stock Awards ($)(c) | Option Awards ($)(d) | Non-Equity Incentive Plan Compensation ($)(e) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(f) | All Other Compensation ($)(g) | Total ($) | ||||||||||||||||||||

| Erik B. Nordstrom | 2021 | 758,700 | — | — | 3,699,999 | 1,941,761 | (692,013) | 44,686 | 5,753,133 | ||||||||||||||||||||

| Chief Executive Officer | 2020 | 367,419 | — | 1,592,846 | 2,654,740 | — | 1,010,681 | 21,984 | 5,647,670 | ||||||||||||||||||||

| 2019 | 756,393 | — | 1,592,836 | 1,061,897 | 708,591 | 2,700,516 | 52,070 | 6,872,303 | |||||||||||||||||||||

| Anne L. Bramman | 2021 | 812,892 | — | 1,319,977 | 879,995 | 1,040,246 | — | 24,679 | 4,077,789 | ||||||||||||||||||||

| Chief Financial Officer | 2020 | 699,231 | — | 1,999,988 | 1,824,997 | — | — | 14,411 | 4,538,627 | ||||||||||||||||||||

| 2019 | 793,750 | — | 1,549,974 | 1,859,994 | 564,500 | — | 39,912 | 4,808,130 | |||||||||||||||||||||

| Peter E. Nordstrom | 2021 | 758,700 | — | — | 3,699,999 | 1,941,761 | (1,364,580) | 56,475 | 5,092,355 | ||||||||||||||||||||

| President and Chief Brand Officer | 2020 | 367,419 | — | 1,592,846 | 2,654,740 | — | 1,055,774 | 24,849 | 5,695,628 | ||||||||||||||||||||

| 2019 | 756,393 | — | 1,592,836 | 1,061,897 | 708,591 | 2,782,378 | 77,355 | 6,979,450 | |||||||||||||||||||||

| Kenneth J. Worzel | 2021 | 892,123 | — | 1,443,737 | 962,494 | 1,427,077 | 1,389,900 | 32,195 | 6,147,526 | ||||||||||||||||||||

| Chief Customer Officer | 2020 | 764,597 | — | 2,624,977 | 2,374,996 | — | 864,312 | 18,367 | 6,647,249 | ||||||||||||||||||||

| 2019 | 826,111 | — | 1,999,970 | 2,400,000 | 645,433 | 1,589,618 | 37,080 | 7,498,212 | |||||||||||||||||||||

| Edmond Mesrobian | 2021 | 827,123 | — | 1,394,971 | 929,995 | 815,262 | — | 12,158 | 3,979,509 | ||||||||||||||||||||

| Chief Technology Officer | 2020 | 677,214 | — | 1,549,973 | 1,374,995 | — | — | 7,917 | 3,610,099 | ||||||||||||||||||||

| 2019 | 743,542 | — | 2,087,450 | 1,304,995 | 420,971 | — | 10,225 | 4,567,183 | |||||||||||||||||||||

| Benefit | Where to Learn More | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Broad-Based (including Executives) | •Company contribution to medical, dental and vision coverage

: Company matching contributions are made each pay period an employee contributes to the 401(k) Plan, equal to a dollar for dollar match up to 1% of eligible pay, then $0.50 per dollar on the next 6% of eligible pay, up to a maximum of 4% of eligible pay and IRC •Short- and long-term disability •Life insurance •Relocation assistance •Merchandise discount •NDCP including Company •Paid time away •Health savings account and flexible spending accounts •ESPP | •For 401(k) •

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Executive Benefits |

•Executive Severance Plan •SERP: This program closed to | •For Retiree Health and | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 Proxy Statement | 46 | ||||||||||||

| Compensation Governance | ||

Compensation, People and Culture Committee Our CPCC oversees the development and delivery of our pay and benefits philosophy and compensation plans for the NEOs and other executives as described in the CPCC charter. As part of that oversight, the CPCC ensures the NEOs’ aggregate compensation aligns with shareholder interests by reviewing analyses that include: •Cash alignment to evaluate the short-term incentive payouts relative to our financial performance •Relative pay and performance to compare the percentile rankings of our CEO’s total direct compensation (base salary + performance-based bonus + LTIs) and our Company’s financial performance metrics within our peer group. The total direct compensation of our NEOs within our peer group is also considered. CPCC Consultant The CPCC has retained Semler Brossy. A consultant from the firm attends CPCC meetings and, in support of the CPCC’s role, provides independent expertise on market practices, compensation program design and related subjects as described on page 18. Semler Brossy provides such services only as directed by the CPCC. During fiscal year 2023, Semler Brossy’s services included a review of executive and Director pay programs, a review of the compensation peer group and other pay-related matters specific to the CPCC’s charter. With respect to Director pay, Semler Brossy provides its services to the CGNC. Management Our CEO and the President & Chief Brand Officer provide input to the CPCC on the level and design of compensation elements for the NEOs and other Executive Officers, excluding themselves. Our Chief Human Resources Officer attends CPCC meetings to provide perspective and expertise relevant to the agenda. Management supports the CPCC’s activity by providing analyses and recommendations developed internally. NEOs are not present for discussions of their own pay.

Market Data Provides a Reference Point for Compensation The CPCC believes that knowledge of market practices, particularly those of our peers listed below, is helpful in assessing the design and targeted level of our executive compensation package. In reviewing peer group information, the CPCC uses survey data provided by external consultants, monitors general market movement for executive pay and references proxy statements for specific roles. While the CPCC considers the 50th percentile (median) of our peer group as a reference, there is no specific percentage of target total direct compensation targeted by the CPCC other than to remain generally competitive with similarly situated peer companies. Target opportunities for individual pay elements vary by executive role based on scope of responsibilities and expected contributions. Target total direct compensation for 2023 for Erik Nordstrom was below our peer group median, as it has been in previous years. Based on the CPCC’s review of relevant market data and internal pay equity, the CPCC believes the target total direct compensationfor the other NEOs was within a competitive range of the peer group median. Actual pay for the NEOs can exceed our established targets or peer group actual pay through the variable compensation elements when pre-determined performance milestones established by the CPCC are achieved. Peer Group Companies Represent Our Business Each year, the CPCC reviews the appropriateness of our peer group for comparison on pay and related practices. Collectively, the peer group companies represent our primary business areas, including our Nordstrom, Nordstrom Rack, in-store and online businesses and private label products. The peer group companies generally meet the following selection criteria: •fall within the Consumer Discretionary sector; •fall within a reasonable range of our size, defined as one-third to three times our revenue and one-fourth to four times our market capitalization; •share similar talent, operational and/or business characteristics, including a retail-focused business model; •have a similar or related product focus and place a high value on customer experience; •are part of our industry group as defined by institutional shareholders and shareholder service organizations; and •are a public company subject to similar market pressures. Our peer group used for evaluating compensation for fiscal year 2023 was comprised of the following retail companies:

During 2023, as part of its annual review of peer companies to be used for compensation comparison purposes, the CPCC made no changes to the peer group. Compensation Risk Assessment Supports Integrity of Our Pay Practices The CPCC oversees an extensive review of the Company’s pay-for-performance philosophy, the composition and balance of elements in the compensation package and the alignment of plans with shareholder interests to ensure these practices do not pose a material adverse risk to the organization. The review is conducted every other year, as underlying programs and practices are generally consistent over time. The last review, for fiscal year 2022, concluded with the following perspectives: •The goals of the Company’s compensation programs are to attract and retain the best talent and to motivate and reward our people in ways that are aligned with the interests of our shareholders. This has been a long-standing objective of our pay-for-performance philosophy. We believe that the strong alignment of our employee compensation plans with performance has well-served our stakeholders, and our shareholders in particular. The strength of this alignment is regularly reviewed and monitored by the CPCC. •We have systems in place to identify, monitor and control risks, making it difficult for a single individual or a group of individuals to expose the Company to material compensation risk. •Our compensation program rewards both short- and long-term performance. Performance measures are predominantly team-oriented rather than individually focused, and tied to measurable factors that are both transparent to shareholders and drivers of shareholder return. •The compensation program balances the importance of achieving critical short-term objectives with a focus on realizing long-term strategic priorities. Strong stock ownership guidelines are in place for Company leaders, and mechanisms, such as our Clawback Policy, exist to address inappropriate rewards.

•The CPCC is actively engaged in establishing compensation plans, monitoring these plans during the year and using discretion in making rewards, as necessary. •The Company has active and engaged oversight systems in place. The AFC and the full Board closely monitor and certify the performance that drives employee rewards through detailed and transparent financial reporting, which is in place to provide strong, timely insight into the performance of the Company. Based on this review, the CPCC believes the Company’s compensation plans do not encourage risk taking that is reasonably likely to have a material adverse effect on the Company. Clawback Policy Applies to Performance-Based Pay In 2023, we revised our Clawback Policy, and in 2024, we publicly filed our new Clawback Policy, each in accordance with the SEC’s adoption of the final rules implementing the incentive-based compensation recovery provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act and NYSE’s adoption of compensation recovery listing standards. Our Clawback Policy provides for the mandatory recovery of erroneously awarded incentive-based compensation from current and former executive officers of the Company in the event that the Company is required to restate its financial results due to the Company’s material noncompliance with any financial reporting requirement under the securities laws, including any required accounting restatement to correct an error in previously filed financial statements with the SEC that (i) is material to the previously filed financial statements, or (ii) would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period. Under our Clawback Policy, recovery of any such compensation is required regardless of whether the officer who received erroneously awarded compensation engaged in misconduct or otherwise caused or contributed to the requirement of an accounting restatement. LTI Grants Are Effective On the First Day of the Open Trading Window The CPCC considers annual equity-based awards at its annual February meeting, which is typically held approximately three weeks after fiscal year-end, and approves such awards either at that meeting or in the days shortly following. Annual grants are customarily effective on the first day of the Company’s next open trading window following CPCC approval. The CPCC may approve one-time equity-based grants to executives on other dates for reasons such as newly hired executives or for retention purposes. Such grants are generally effective on the first day of the Company’s next open trading window following approval by the CPCC. Termination and Change in Control Provisions Are CPCC-Directed Under our Nordstrom, Inc. Executive Severance Plan, eligible Executive Officers, including certain NEOs, are entitled to receive severance benefits upon involuntary termination of employment by the Company to assist in the transition from active employment. To be eligible to participate in the plan upon involuntary termination, the NEO must have signed a non-competition and non-solicitation agreement. Erik Nordstrom and Peter Nordstrom are not eligible for separation benefits under the plan. Separation benefits are described in the Potential Payments Upon Termination or Change in Control section beginning on page 60. As described in the same section, the NEOs are generally not entitled to any payment or accelerated benefit in connection with a change in control of the Company. However, the NEOs are entitled to accelerated vesting of equity if they experience a qualifying termination (termination by the Company without cause or termination by the executive for good reason) within 12 months following a change in control. Notwithstanding, if the successor corporation refuses to assume or substitute the award, then the CPCC shall provide for the cancellation of the vested portion of any such award in exchange for either an amount of cash (or stock, other securities or other property) and provide for the cancellation of the unvested portion of the award, if any, without payment of consideration. Tax and Accounting Considerations Underlie the Compensation Elements The CPCC recognizes the tax and regulatory factors that can influence the structure of executive compensation programs, including: •Section 162(m) of the IRC, which disallows a tax deduction to public companies for annual compensation over $1 million paid to “covered employees,” which generally include NEOs. Certain performance-based compensation under arrangements in place as of November 2, 2017 are not subject to the limitation. Therefore, compensation in excess of $1 million paid to our NEOs is generally expected to be nondeductible by the Company. •FASB ASC 718, where stock options, PSUs and RSUs are accounted for based on their grant date fair value (see the notes to the financial statements contained within the Company’s 2023 Annual Report). The CPCC regularly considers the accounting implications of our equity-based awards. •Section 409A of the IRC, the limitations of which primarily relate to the deferral and payment of benefits under the NDCP and SERP. The CPCC continues to consider the impact of Section 409A and, in general, the evolving tax and regulatory landscape in which its compensation decisions are made.

Summary Compensation Table The following table summarizes the total compensation paid or accrued by the Company for services provided by the NEOs for fiscal years ended February 3, 2024, January 28, 2023 and January 29, 2022. Neither Cathy Smith nor Jason Morris were NEOs in fiscal years 2022 and 2021, so no amounts are shown in those years. Michael Maher was not a NEO in fiscal year 2021, so no amounts are shown in that year.

(a) Salary The amounts shown represent base salary earned during the fiscal year. The numbers shown for all fiscal years vary somewhat from annual base salaries due to the fact that our fiscal year ends on the Saturday nearest to January 31st and salary increases are generally effective in March. Also, as a result of our 4-5-4 retail reporting calendar, fiscal year 2023 included an extra week (the 53rd week). The 2023 base salaries shown for Cathy Smith, Jason Morris and Michael Maher reflect a partial year of base salary, as Cathy Smith and Jason Morris joined the Company on May 29, 2023 and May 1, 2023, respectively, and Michael Maher left the Company on June 16, 2023.The 2023 base salaries are described on page 43. Kenneth Worzel elected to defer 10% of his base salary earned during calendar year 2023 into the NDCP. Due to the timing of our fiscal year ends, $82,615 was attributed to fiscal year 2023 deferrals for Kenneth Worzel as reported in the Fiscal Year 2023 Nonqualified Deferred Compensation Table on page 59. Each of the NEOs contributed a portion of their base salary earned during fiscal year 2023 to the 401(k) Plan. (b) Bonus This column refers to one-time payments not made under the EMBP. Cathy Smith received a one-time lump sum cash sign-on payment of $550,000 as a consideration for value forfeited by joining the Company.Jason Morris received a cash sign-on payment paid in three installments as a consideration for value forfeited by joining the Company. The first installment of $1,170,000 was paid in fiscal year 2023, with the second and third installments of $415,000 to be paid in fiscal years 2024 and 2025, respectively, contingent upon continued service with the Company. (c) Stock Awards The amounts reported reflect the grant date fair value of PSUs and RSUs granted during the fiscal year under the 2019 EIP. The amounts reported are not the value actually received.

The value the NEOs will ultimately receive from their 2023 and 2022 PSUs will depend on the performance requirements and the market price of Common Stock at the end of the three-year performance cycle. In fiscal years 2023 and 2022, PSUs were granted to Erik Nordstrom, Peter Nordstrom and Kenneth Worzel. The amounts reported were calculated in accordance with ASC 718 and reflect the grant date fair value at target (100%). The minimum number of PSUs that can be earned at the end of each three-year performance cycle is 75% and the maximum is 150%. The grant date fair value for the PSUs awarded in fiscal year 2023 to Erik Nordstrom, Peter Nordstrom and Kenneth Worzel, at the maximum payout of 150%, is $2,389,268, $2,389,268 and $2,013,744, respectively. The grant date fair value for the PSUs awarded in fiscal year 2022 to Erik Nordstrom, Peter Nordstrom and Kenneth Worzel, at the maximum payout of 150%, is $2,389,266, $2,389,266 and $2,013,750, respectively. See column (c) of the Grants of Plan-Based Awards in Fiscal Year 2023 table on page 53 for the target number of PSUs granted in fiscal year 2023. No PSU amounts are reported for fiscal year 2021 as the Company did not award PSUs during the fiscal year. The value the NEOs may receive from their RSUs will depend on whether the time-based vesting requirement is met and the market price of Common Stock on the vesting date. In fiscal year 2023, RSUs were granted to Cathy Smith, Jason Morris and Michael Maher. The amounts reported were calculated in accordance with ASC 718. See column (d) of the Grants of Plan-Based Awards in Fiscal Year 2023 table on page 53 for the number of RSUs granted in fiscal year 2023. (d) Option Awards The amounts reported reflect the grant date fair value of stock options granted during the fiscal year under the 2019 EIP. This is not the value received. The NEOs will only realize value from stock options if the market price of Common Stock is higher than the exercise price of the stock options at the time of exercise. The amounts reported were calculated in accordance with ASC 718. See column (e) of the Grants of Plan-Based Awards in Fiscal Year 2023 table on page 53 for the number of stock options granted in fiscal year 2023. Assumptions used in the calculation of these amounts are included in the notes to the financial statements contained within the Company’s 2023 Annual Report. (e) Non-Equity Incentive Plan Compensation The amounts reported reflect the annual performance-based cash awards under the EMBP, as described on page 43. Kenneth Worzel deferred $433,649 of his cash award earned in fiscal year 2023 into the NDCP. (f) Change in Pension Value and Nonqualified Deferred Compensation Earnings The amounts reported are the increases in actuarial present value from each fiscal year end for each of the eligible NEO’s benefit under the SERP. The present value of the benefit is affected by current earnings, credited years of service, the executive’s age and time until normal retirement eligibility, the age of the executive’s spouse or life partner as the potential beneficiary, actuarial assumptions (discount rate and mortality table used to determine the present value of the benefit), and the annual SERP benefit cap of $700,000. The present value of Erik Nordstrom’s and Peter Nordstrom’s benefit decreased from 2022 fiscal year end by $511,700 and $516,320, respectively. The decreases were primarily the result of an increase in the discount rate used to determine the present value of the benefits. The interest rate used is the same as the discount rate used for financial reporting purposes for the SERP, which changed from 4.95% to 5.27%. Negative values are not reported in the table, so no amounts are shown for Erik Nordstrom and Peter Nordstrom. The present value of Kenneth Worzel’s benefit increased by $465,523, primarily due to an increase to service, which more than offset any decrease due to the change in the discount rate. Amounts are not reported for the other NEOs, as they are not eligible for the SERP benefit. The amounts were calculated using the same discount rate assumptions as those used in the Company’s financial statements to calculate the Company’s obligations under the SERP. Assumptions used in the calculation of these amounts are included in the notes to the financial statements contained within the Company’s 2023 Annual Report. Kenneth Worzel and Michael Maher had account balances in the NDCP in fiscal year 2023, as shown on page 59. They did not receive above-market-rate or preferential earnings on their deferred compensation, so no amounts for these types of earnings are included in the table. (g) All Other Compensation Each component of all other compensation paid to the NEOs is shown in the following table.

The following table shows each component of “All Other Compensation” for fiscal year 2023, reported in column (g) of the Summary Compensation Table on page 50, calculated at the aggregate incremental cost to the Company.